The box truck business is all hustle. For many truck drivers and delivery services, waiting up to 90 days to get paid makes it hard to keep up with fuel, maintenance, and payroll. This delay hits especially hard for startups or owner-operators who rely on fast-moving cash flow to keep their wheels turning.

Invoice factoring offers a practical and immediate solution. Instead of waiting for brokers or shippers to pay, truckers can turn their invoices into cash, often within 24 to 48 hours. It’s not a loan, and it doesn’t add debt. It’s a straightforward exchange that helps delivery businesses stay on the road and in control of their operations.

Whether you’re running a single used truck with a non-CDL driver or managing multiple routes under an MC number, factoring fits businesses of all sizes. With consistent access to working capital, box truck operators can stop stressing over late payments and focus on what matters.

Understanding the Financial Strain of Box Truck Operations

Running a box truck business comes with serious startup costs and ongoing expenses. From buying a used truck and setting up your MC number to managing fuel card bills, breakdowns, tolls, and insurance premiums, overhead adds up quickly. Add payroll or contractor payments to the mix, and cash flow becomes a daily concern.

Trucking insurance, fuel prices, and unexpected repairs can drain your reserves long before customers pay you. That’s a problem, because brokers and shippers often take 30, 60, or even 90 days to settle invoices.

For new trucking businesses trying to create solid financial projections or expand their operations, that delay is more than inconvenient—it can be disruptive. Every dollar tied up in unpaid invoices means fewer funds for fuel, maintenance, and growth. Invoice factoring helps by freeing up working capital without taking on debt.

What Is Invoice Factoring, and How Does It Work?

Invoice factoring is a fast and flexible way for truckers to turn invoices into immediate cash without waiting weeks to get paid. Here’s what the process typically looks like:

- Complete the haul. You finish your delivery as usual.

- Submit your invoice. Send the completed invoice to your factoring company.

- Get paid fast. Receive a cash advance—usually within 24 to 48 hours.

- Broker pays the factor. When the broker eventually pays, the factoring company deducts its fee and sends you the remaining balance.

This model works well whether you’re a trucker with a commercial driver’s license, a non-CDL driver running your own box truck, or a growing business with an MC number. By speeding up cash flow without debt, factoring gives box truck operators more control—and more flexibility—to stay on the move.

Key Benefits of Invoice Factoring for Box Truck Businesses

Time is money for box truck operators, and waiting for invoice payments can stall everything from fuel-ups to payroll. Invoice factoring turns that lag into leverage by giving businesses near-instant access to their earned revenue.

But the benefits go beyond speed. Here’s how factoring helps box truck businesses streamline operations, reduce stress, and grow with confidence.

Immediate Access to Cash Flow

Delayed payments from brokers and shippers can leave you scrambling to cover critical expenses. Invoice factoring bridges that gap—no more waiting weeks to pay for fuel, maintenance, or your dispatcher.

Factoring rates typically range from 0.75% to 3.5%, giving you fast access to funds while preserving control of your operations.

With factoring, money moves quickly—right into your business bank account—so you can stay focused on booking jobs through load boards, meeting deadlines, and keeping your routes running.

Simplified Back-Office Operations

For many small business owners in the trucking world, admin work is a burden. Managing collections, chasing payments, and reconciling accounts eats up time you could be spending on deliveries.

Factoring companies handle payment collection directly with your brokers, reducing paperwork and hassle. That means sole proprietorships and other small businesses can reclaim their time, redirecting it toward growth and route expansion.

That means less time on the phone, more time behind the wheel.

Flexibility as Your Business Grows

Unlike traditional loans, invoice factoring adapts to your workload. As your invoice volume increases, so does your access to funding, without the need to reapply or renegotiate terms.

That’s a major win for box truck owner-operators trying to grow into a successful box truck business. Whether you’re expanding into new markets, hiring drivers, or taking on new contracts, factoring grows alongside your box truck company.

Common Use Cases: When Box Truck Businesses Rely on Factoring

Invoice factoring supports critical operational moments, from covering costs between jobs to capitalizing on growth opportunities. This section breaks down common scenarios where factoring keeps box truck businesses moving forward.

Covering Fuel and Driver Wages Between Jobs

Imagine you’re waiting on $4,000 in unpaid invoices, but payroll and fuel bills totaling $1,200 are due this week. This is a common cash gap for any owner-operator managing a small fleet or driving semi trucks.

Instead of delaying payments or racking up debt, factoring lets you access the cash you’ve already earned—no loans required. With that advance, your operations stay uninterrupted, and your team stays on the road.

Taking on More Loads Without Waiting for Payments

Some opportunities come fast, but funding doesn’t always keep up.

Say a box truck owner is offered three new loads but lacks the cash to cover upfront costs like fuel, tolls, or temporary drivers. Factoring turns their unpaid invoices into working capital, allowing them to say yes to more freight brokers without pausing for payments.

That’s how factoring lets you keep your schedule full and your routes optimized, whether you’re running out of a truckstop or moving cargo van freight across state lines.

Seasonal Volume Spikes and Unpredictable Demand

Holidays, event surges, and new contracts can flood your schedule with opportunities—and pressure. E-commerce booms, Amazon Relay routes, and last-mile delivery spikes all require quick response times and flexible funding.

Factoring gives you the cash you need to scale up fast so you can hire temporary help, fuel up more trucks, or manage logistics without tapping credit. When demand shifts, you’ll be ready.

How To Choose the Right Factoring Partner

Not all factoring companies operate the same way. Choosing the right partner means understanding essential terms, spotting potential red flags, and evaluating offers that support your box truck business goals.

Start by getting familiar with these key terms that affect your bottom line:

- Advance rates. The percentage of your invoice the factoring company pays you upfront.

- Recourse vs. non-recourse. Determines who’s responsible if your broker doesn’t pay—you or the factor.

- Fees. May be flat or variable depending on invoice volume, payment timelines, or contract terms. For example, a factoring rate of 3.25% means you’d pay $32.50 for every $1,000 in factored invoices.

Be on the lookout for common red flags that can cost you:

- Hidden fees. Charges buried in the fine print that increase your true cost.

- Long contracts. Agreements that are hard to exit or renegotiate.

- Volume minimums. Penalties for small operations that don’t meet monthly thresholds.

Finally, make sure your factoring company understands regulatory essentials like your:

- FMCSA registration

- DOT number

- BOC-3 filing

- Liability insurance

- USDOT number

- Operating authority under the Federal Motor Carrier Safety Administration

A reliable partner will be fluent in these requirements.

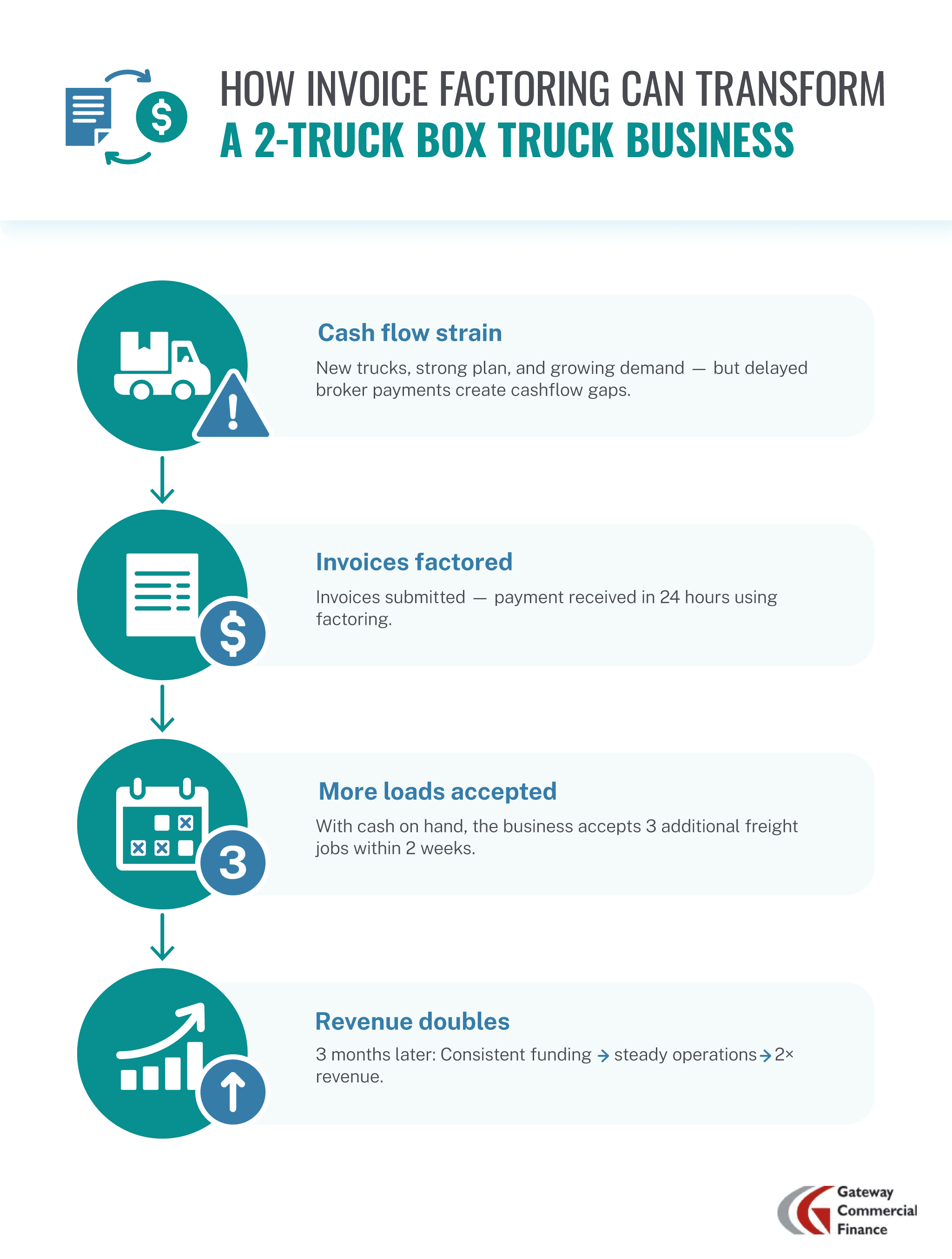

Case Study: From Cash Crunch to Growth

Consider a two-truck box truck startup with a new box truck, a clear box truck business plan, and a growing list of potential customers. Even with the right equipment and a strong foundation, long waits on broker payments can slow progress and limit opportunities.

Factoring offers a step-by-step path to stability. With fast payments—often within 24 hours—the business gains the flexibility to accept more loads, pay expenses on time, and scale with confidence.

Frequently Asked Questions About Factoring in Trucking

Factoring can be unfamiliar if you’re just exploring it as a funding option. Here are answers to the most common questions box truck operators ask.

Is Factoring a Loan?

No. Factoring isn’t a loan; it’s a way to get paid faster by selling your unpaid invoices. There’s no added debt or interest, and it won’t affect your credit.

How Fast Do I Get Paid?

Most factoring companies pay within 24 to 48 hours after invoice submission. Once your account is set up, some even offer same-day funding.

Will Clients Know I Use Factoring?

Yes, but it’s standard in the industry. Since the factor receives payment directly, your broker will be notified, but the interaction is handled professionally.

What if My Broker Doesn’t Pay?

In recourse factoring, you’re responsible if the broker fails to pay. In non-recourse agreements, the factoring company assumes the risk. Always check the agreement to understand which model applies.

Factoring as a Competitive Edge in Box Trucking

Factoring isn’t just about solving cash flow problems—it’s about unlocking momentum. From covering payroll between jobs to ramping up during busy seasons, invoice factoring helps box truck businesses stay flexible, responsive, and profitable.

Gateway Commercial Finance makes that process seamless. Whether you’re booking your next pickup, running routes influenced by social media demand, or scaling across state lines, they understand the day-to-day realities of the box truck industry and offer support that grows with you.

Get Paid Faster With Gateway Commercial Finance

Tired of waiting on slow-paying brokers? Get paid faster with Gateway Commercial Finance and turn your outstanding invoices into working capital today.