Summary: Gateway Commercial Finance explores how small businesses are responding to economic uncertainty in 2025 through trends in optimism, hiring, revenue, and access to credit.

Small businesses make up nearly half of all private-sector jobs in the U.S. They help drive local economies, spark innovation, and keep communities running. Because of their impact, their mood often reflects bigger shifts in the economy.

Right now, that mood isn’t great. The NFIB Small Business Optimism Index has consistently dropped from January to April 2025. Rising labor costs, persistent inflation, and tighter access to credit are creating major planning challenges for many small business owners.

To understand how small businesses are responding to these challenges, Gateway Commercial Finance, an invoice factoring company, analyzed the latest data from the National Federation of Independent Business (NFIB), the U.S. Bureau of Labor Statistics (BLS), and the Fed Small Business Credit Survey. This study highlights key trends in small business optimism, hiring, and financial health.

The mood on Main Street: Optimism and uncertainty

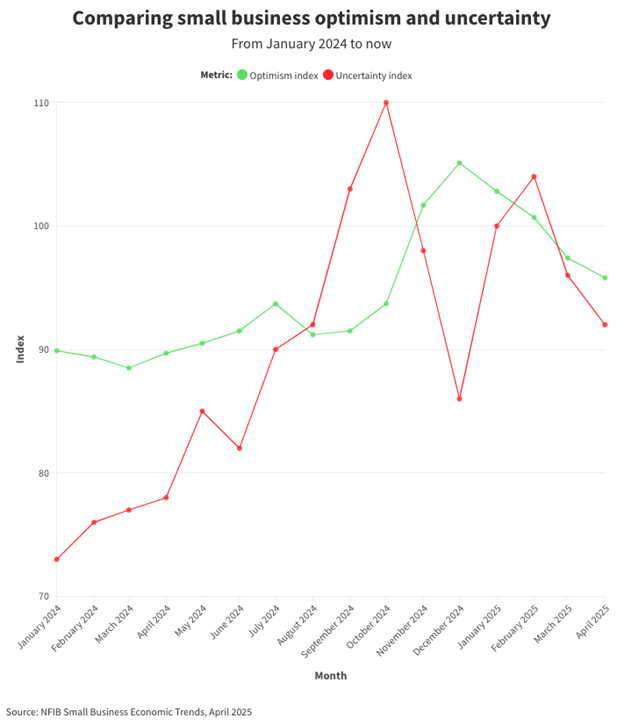

In March 2025, the NFIB Small Business Optimism Index dropped 3.3 points to 97.4. This is the sharpest monthly decline the index has seen since June 2022, bringing it below its historical 51-year average of 98. It fell another 1.6 points in April 2025, marking the fourth consecutive monthly dip. The downturn was driven primarily by weakened expectations for future business conditions and unfilled job openings.

Business owners are less certain about what will happen next. In February 2025, the NFIB Uncertainty Index jumped to 104, its second-highest level in more than 50 years. This kind of uncertainty makes planning tough. Many small businesses are slowing down decisions about hiring, spending, and growth. When the future looks shaky, most choose to wait things out.

Labor market pressures: Hiring, quits, and layoffs

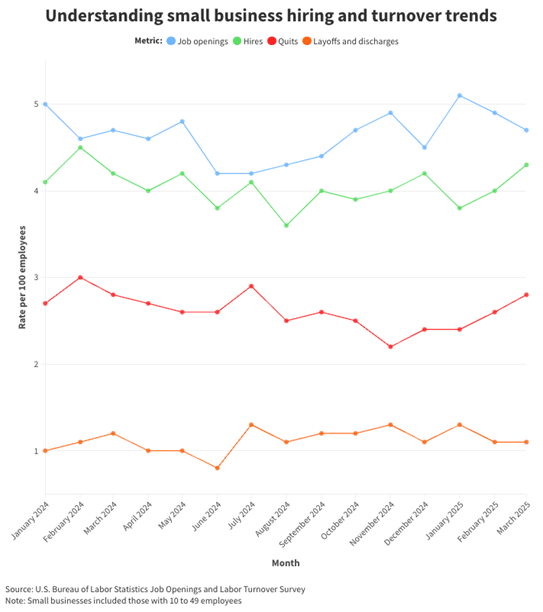

According to the BLS Job Openings and Labor Turnover Survey, staffing trends at small businesses (10 to 49 employees) have shifted in early 2025. Small business owners are treading carefully when it comes to growing their teams, but that doesn’t mean hiring has stopped. Some are bringing on new people and finding ways to adapt in a shifting labor market.

Here’s what the data shows:

- Job openings are down. Some employers could be holding off on creating new positions while they wait for more economic clarity.

- Hiring is steady. Despite fewer openings, many businesses are still filling roles as needed.

- More people are quitting. Workers seem more confident about finding better opportunities elsewhere.

- Layoffs have slowed. Fewer businesses are cutting staff, which points to a degree of stability.

Small business financial health and credit access

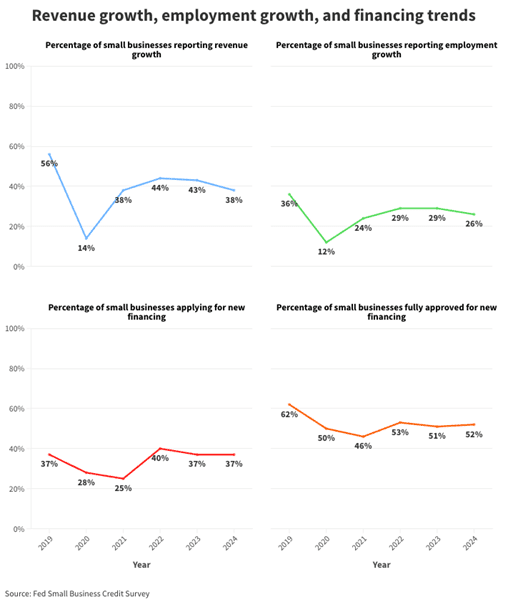

Financial health is still a weak spot for many small businesses. Fewer are reporting revenue or job growth, based on the most recent Fed Small Business Credit Survey. These numbers haven’t bounced back to where they were before the COVID-19 pandemic.

Access to credit isn’t helping much either. While the share of businesses applying for new credit has returned to pre-2020 levels, approval rates have slipped. Before the pandemic, 62% of applicants received full approval for financing; that figure now sits at just 52%. This drop in access to capital may further constrain investment, hiring, and long-term planning for many small businesses.

Navigating uncertainty with cautious resilience

Small businesses continue to be an important part of the U.S. economy, but many are moving carefully as uncertainty persists. With optimism declining, hiring trends shifting, and credit access tightening, owners are prioritizing stability over aggressive growth. The latest data points to a period of adjustment—not acceleration, but not retreat either. How small businesses respond in the months ahead will help shape the bigger economic picture.

Methodology

For this study, we leveraged the April 2025 NFIB Small Business Economic Trends report, the U.S. Bureau of Labor Statistics’ JOLTS Estimates, and the annual Fed Small Business Credit Survey to understand small business optimism and uncertainty, job openings, hiring, turnover, and employment and revenue growth.

This story was produced by Gateway Commercial Finance and reviewed and distributed by Stacker.

Author: Evan Ullman for Gateway Commercial Finance