For business owners juggling cash flow and long-term growth, flexible access to working capital can make a measurable difference. One solution often considered is a secured line of credit (LOC)— a revolving financing option backed by business assets.

This guide breaks down what a secured line of credit is, how it compares to unsecured options, and when it might be the right fit. You’ll learn the potential benefits, key risks, and alternative funding methods, including how invoice factoring offers a non-debt path to liquidity. Whether you’re managing seasonal expenses or exploring ways to strengthen your financial position, this article will help you evaluate your options with clarity and confidence.

What Is a Secured Line of Credit?

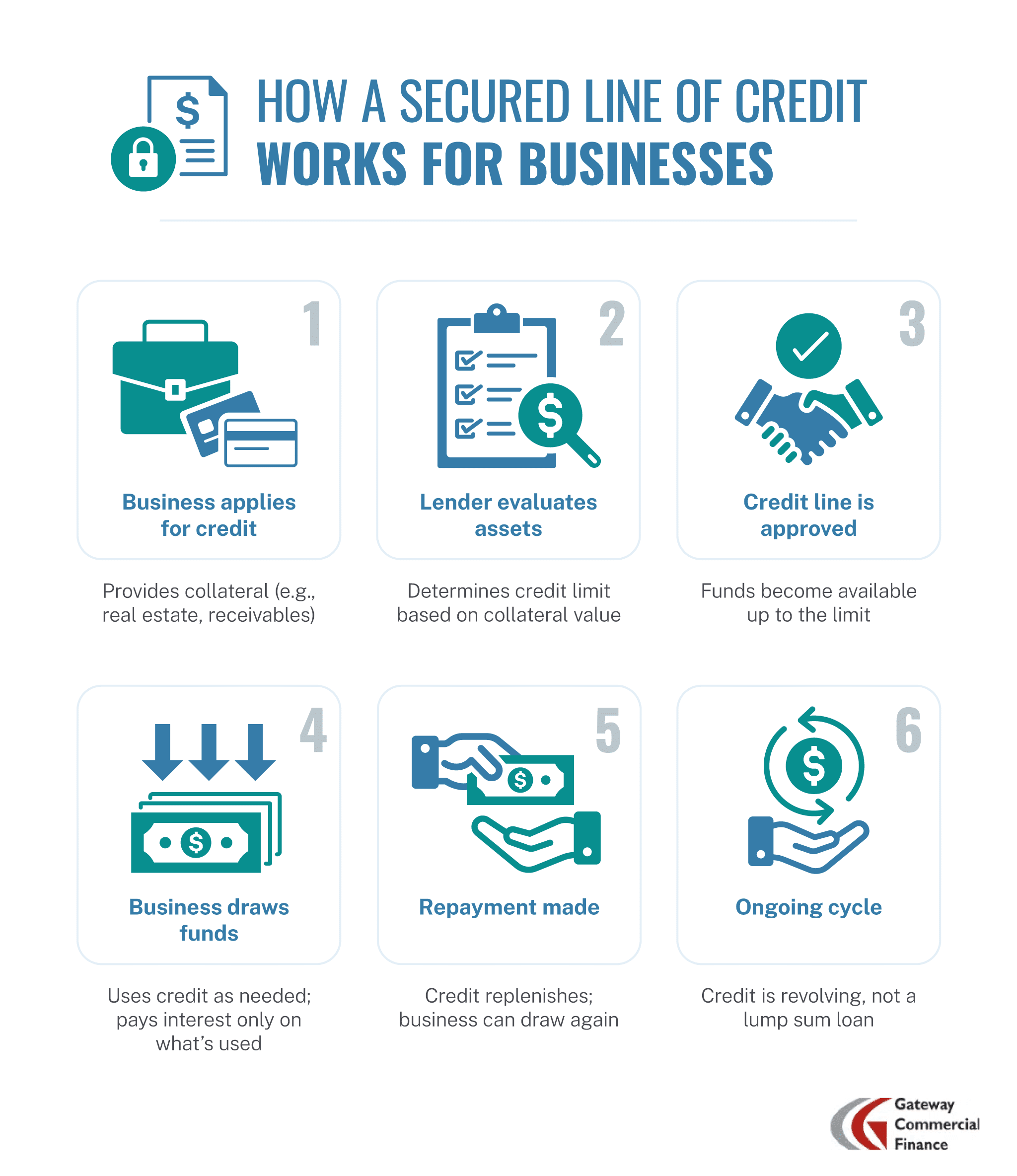

A secured line of credit is a financing arrangement that lets a business borrow money against collateral, such as real estate, inventory, or accounts receivable. It functions like a credit card: a company gets access to a predetermined credit limit and can draw from it as needed, paying interest only on the amount used.

Unlike term loans, secured lines of credit are revolving, meaning businesses can borrow, repay, and borrow again within their credit limit. The key distinction is the collateral, which reduces the lender‘s risk and typically leads to more favorable terms for the borrower. This option suits B2B companies with valuable assets but limited cash flow or credit history, giving them more flexibility without taking on traditional debt.

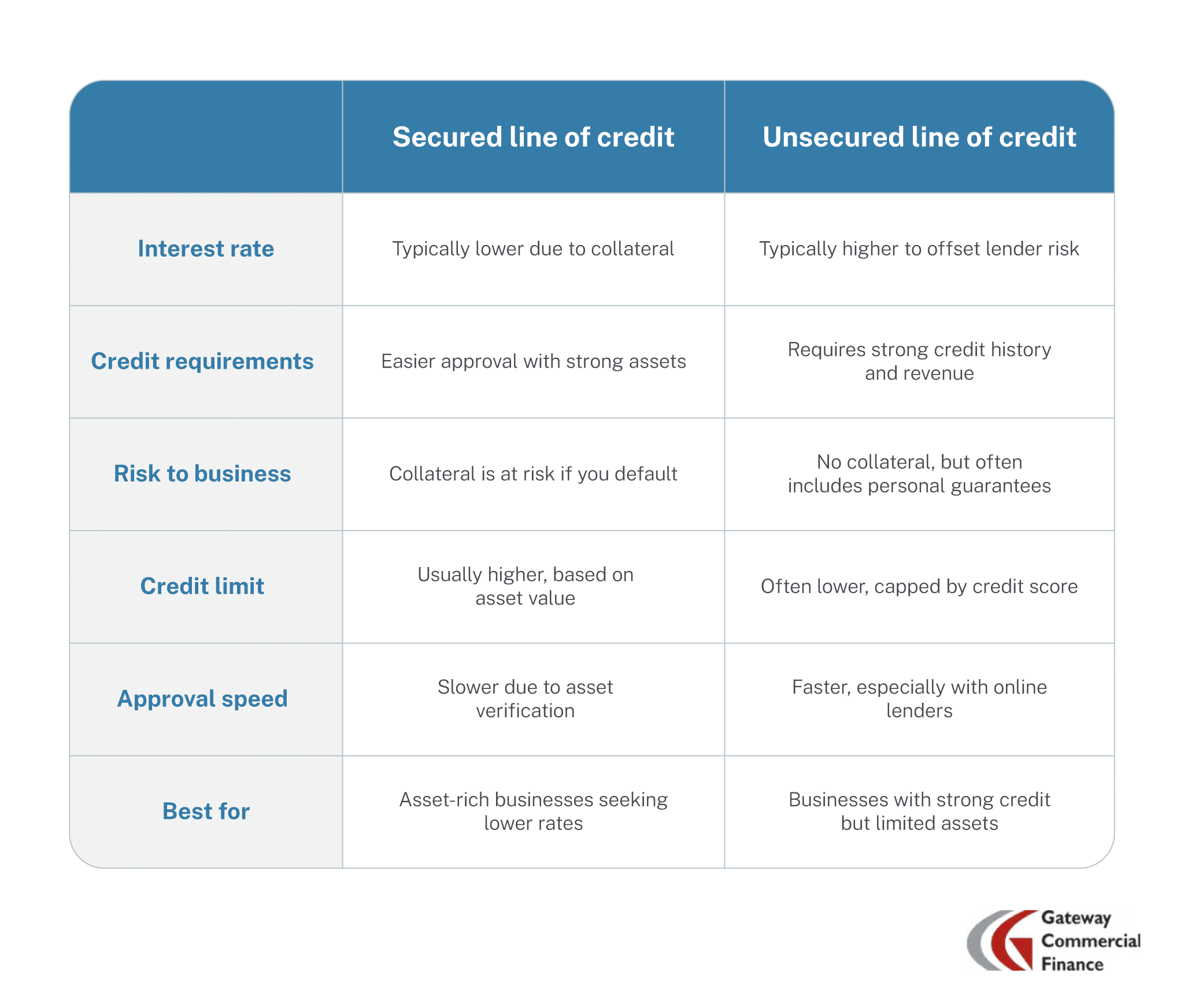

Secured vs. Unsecured Line of Credit: Key Differences

The choice between a secured and unsecured line of credit depends on your company’s credit profile, collateral, and financing goals. Here’s how they compare:

Benefits of a Secured Line of Credit

A secured line of credit can offer several advantages for businesses that have qualifying collateral and need flexible access to capital:

- Lower borrowing costs. With collateral reducing risk, interest rates are often significantly lower than unsecured options.

- Higher credit limits. Limits are tied to asset value, allowing businesses to access more capital.

- Simpler approval. Businesses with limited credit history or lower scores may still qualify if they have strong collateral.

- Helps build credit. Timely repayment can strengthen a business’s credit profile over time, improving access to future financing.

- Demonstrates creditworthiness. Maintaining a secured credit line and paying on time can help position your business for future financing opportunities.

- Interest-only payments. Businesses only pay interest on the amount they use, making it an efficient option for managing working capital.

- Improves access to future credit offers. Responsible use and strong payment history may open the door to more favorable terms over time.

Risks and Drawbacks To Consider

While a secured line of credit can offer valuable flexibility, there are important risks that business owners should evaluate before committing:

- Collateral risk. If your business can’t repay the borrowed amount, the lender can seize the pledged assets, potentially disrupting operations or long-term plans.

- Slower funding timeline. Verifying the value of collateral adds time to the approval process, which may not suit businesses with urgent cash needs.

- Tied-up capital. Assets used as collateral can’t be leveraged for other financing, reducing overall agility in capital planning.

- Ongoing exposure. Because the line is revolving, businesses may fall into a pattern of continual borrowing without decreasing total debt.

- Limited disclosures. Loan terms, fees, and renewal conditions may vary widely by lender, making it critical to review disclosures carefully.

- Opportunity cost. Using valuable assets to secure credit may prevent you from pursuing other financial opportunities or higher-return investments.

Understanding these risks helps decision-makers balance the benefits of access with the long-term impact of securing business assets.

Real-World Scenarios: When a Secured LOC Makes Sense

A secured line of credit can be a flexible financing tool in situations where capital needs fluctuate or arise unpredictably. Common use cases include:

- Inventory management. Businesses preparing for seasonal spikes can use credit to stock up without straining liquidity.

- Bridging receivables. Companies waiting on client payments often tap into credit lines to cover operating costs and monthly payments.

- Renovation or expansion. A secured LOC can help fund large purchases tied to facility upgrades or service expansion without depleting cash reserves.

- Payroll continuity. When revenue is inconsistent, credit lines help maintain payroll and manage other time-sensitive obligations.

- Handling unexpected expenses. Sudden costs, such as equipment failure or urgent repairs, can be covered quickly with available credit.

This type of financing is best suited to businesses with sufficient collateral looking for short-term flexibility over long-term debt.

Application Process: Step-by-Step

The application processes for secured lines of credit can vary, but most follow these common steps:

- Check credit requirements. Ensure your business meets minimum credit score thresholds, often starting around 500.

- Gather financial documents. Prepare bank statements, tax returns, and cash flow projections.

- Identify collateral. List assets such as receivables, equipment, or real estate to secure the credit line.

- Submit application. Complete the lender‘s form and provide all requested documentation.

- Undergo asset valuation. The lender will appraise your collateral to determine loan terms and credit limits.

- Receive approval and terms. If approved, you’ll receive a credit agreement outlining your limit, interest rate, and repayment structure.

- Access funds. Once finalized, your line becomes active and available for drawdown as needed.

For authoritative guidance on funding programs and eligibility benchmarks, visit the U.S. Small Business Administration.

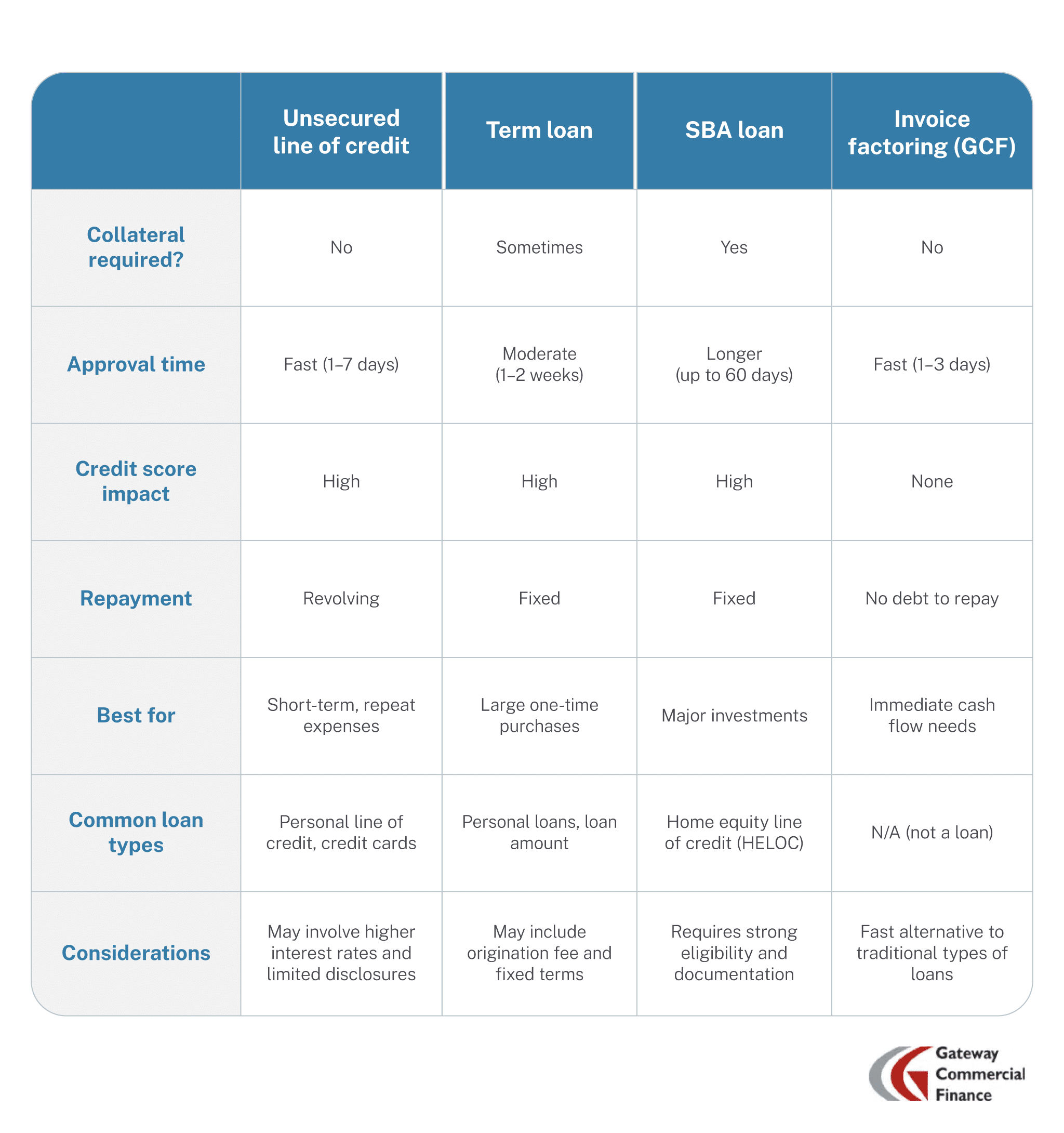

Alternatives to a Secured Line of Credit

Depending on your credit profile, timing, and financing goals, other funding options may be more suitable than a secured line of credit. The table below compares common alternatives across key criteria:

Invoice factoring is Gateway Commercial Finance’s core offering — a non-debt, collateral-free option that gives businesses fast access to working capital by advancing funds against outstanding invoices. Unlike credit-based options, factoring doesn’t rely on your credit score or tie up assets.

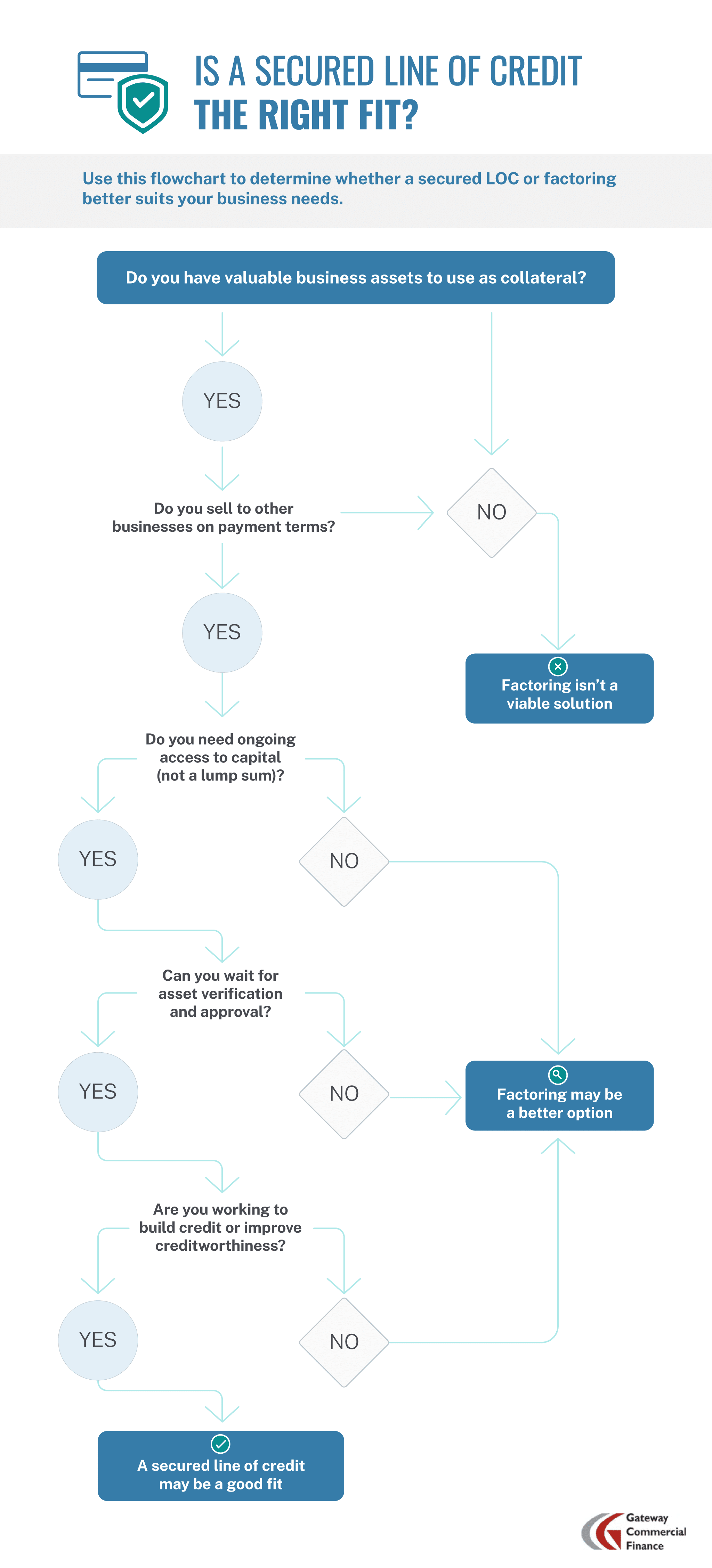

Decision Tool: Is This the Right Financing Solution for You?

Choosing the right financing tool depends on your business goals, funding urgency, and ability to offer collateral. Consider the following questions to determine if a secured line of credit makes sense for your situation:

- Do you have valuable business assets? Collateral like equipment, real estate, or receivables positions you well for a secured loan.

- Do you need flexible access to capital? A line of credit allows for ongoing use, rather than a one-time lump sum.

- Are you building credit? If you have limited credit history, this option may support long-term creditworthiness.

- Can you wait for funding? Secured credit often involves asset verification and underwriting, so it may not suit urgent needs.

If these conditions don’t align with your needs, especially if your top priority is fast funding without taking on debt, factoring may be a better alternative. The best option depends on your timeline, risk tolerance, and working capital requirements.

Weighing Your Options

A secured line of credit can offer valuable flexibility for businesses with assets to pledge and ongoing funding needs. It often delivers lower interest rates and higher credit limits compared to unsecured options, making it an appealing solution for companies focused on managing cash flow strategically.

But it’s not always the fastest or most accessible option — especially for businesses without qualifying collateral or those seeking immediate funding. In these cases, alternatives like factoring can provide working capital without taking on new debt or sacrificing valuable assets.

Before choosing a financing path, take stock of your credit profile, available assets, and how quickly you need access to funds. If you’re looking for fast, non-debt-based funding, factoring may be a better fit.

See how factoring compares. Speak with our experts at Gateway Commercial Finance today.

FAQs

Here are answers to common questions from business owners exploring secured credit options:

What is required to qualify?

Most lenders look for a credit score of 500 or higher, collateral with verifiable value, and at least six months of business history. While you won’t need to share a checking account or savings account to apply, providing accurate financial documentation tied to your bank account is essential for approval.

How quickly can I get funding?

Timelines vary, but funding typically takes one to three weeks due to the need for collateral appraisal and underwriting. Businesses that need faster access to cash may want to compare secured credit with factoring or FDIC-backed lending tools that offer more standardized timelines.

Can I apply with bad credit?

Yes. If you have strong collateral, lenders may approve your application even with lower credit scores, though rates may be higher. Make sure all disclosures are clear and confirm whether any origination fees apply before proceeding.

What can I use as collateral?

Acceptable collateral typically includes real estate, equipment, inventory, and accounts receivable. These assets help reduce lender risk and can influence your credit limit and repayment structure.

Should I consider factoring instead?

If speed, simplicity, and avoiding new debt are priorities, factoring may be the better choice. It also allows you to maintain flexibility with your existing cash resources, including your savings account or member FDIC-insured bank account, without tying them up in a secured credit arrangement.