Delayed customer payments are an inconvenience and a growing threat to small business survival. In 2025, late invoices are creating ripple effects across SMB operations, from hiring and growth to daily cash flow.

Gateway Commercial Finance surveyed over 500 small business owners to uncover just how serious the late payment crisis has become. The findings point to deeper issues than missed due dates. Small businesses are absorbing losses, carrying additional interest expenses, seeking additional sources of working capital, delaying investments, and relying on personal finances to stay afloat.

Key Takeaways

-

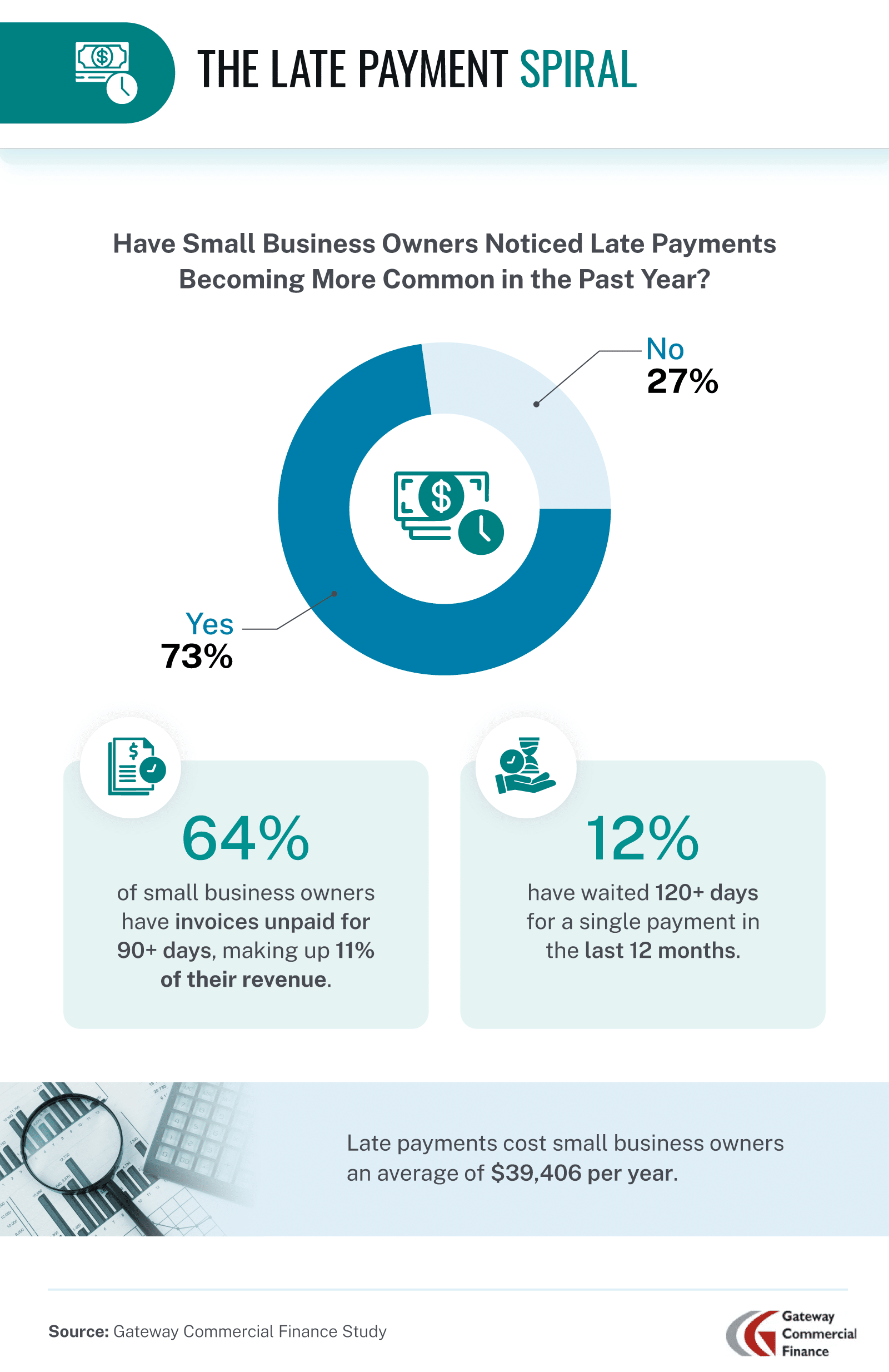

- 73% of small business owners have noticed late payments becoming more common in the past year.

- 64% of small business owners have outstanding invoices for 90 or more days, which account for 11% of their revenue.

- Due to late payments, small business owners estimate their business loses an annual average of $39,406; 9% estimate yearly losses of $100,000 or more.

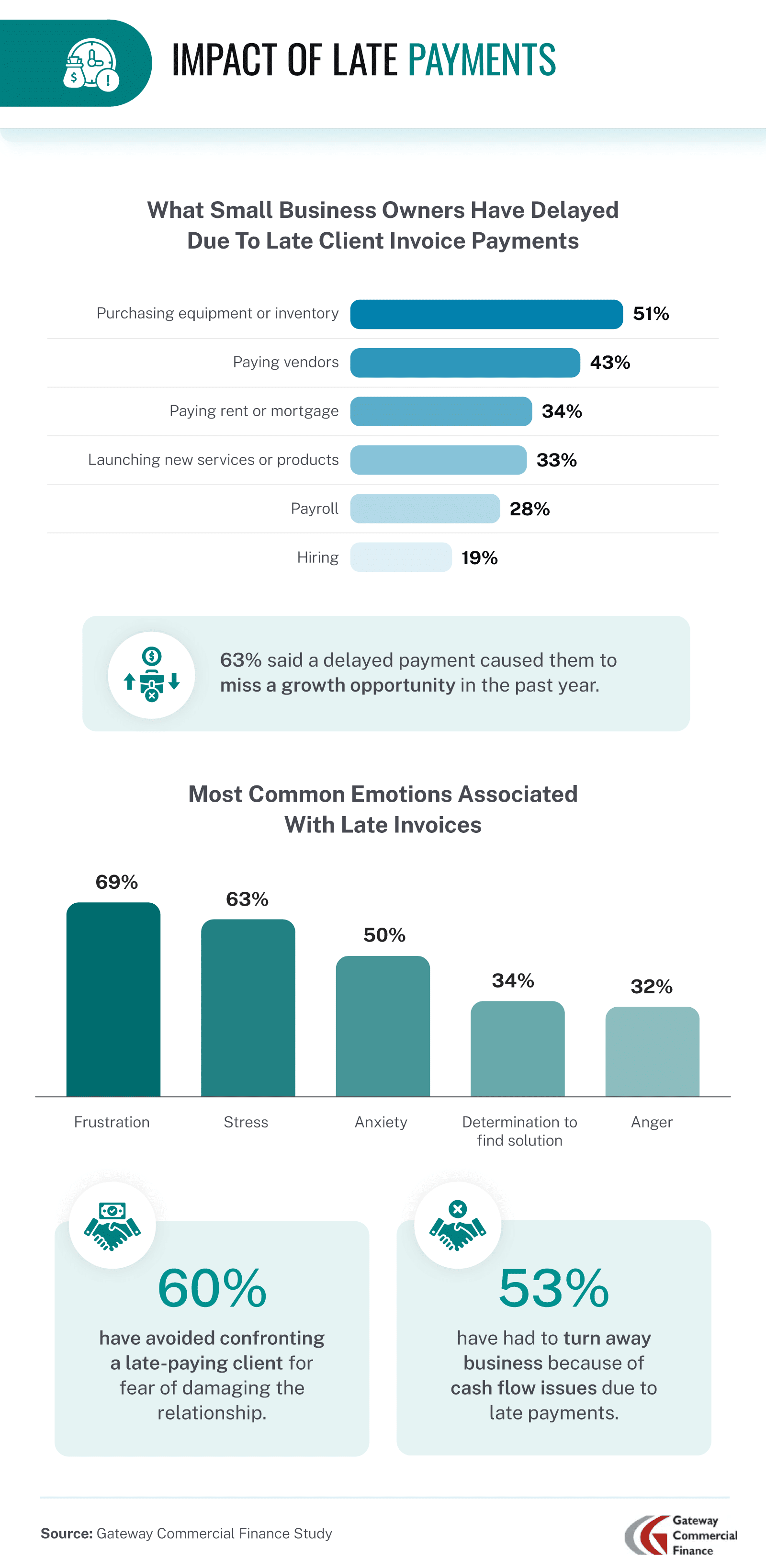

- 63% of small business owners said a delayed payment caused them to miss a growth opportunity in the past year.

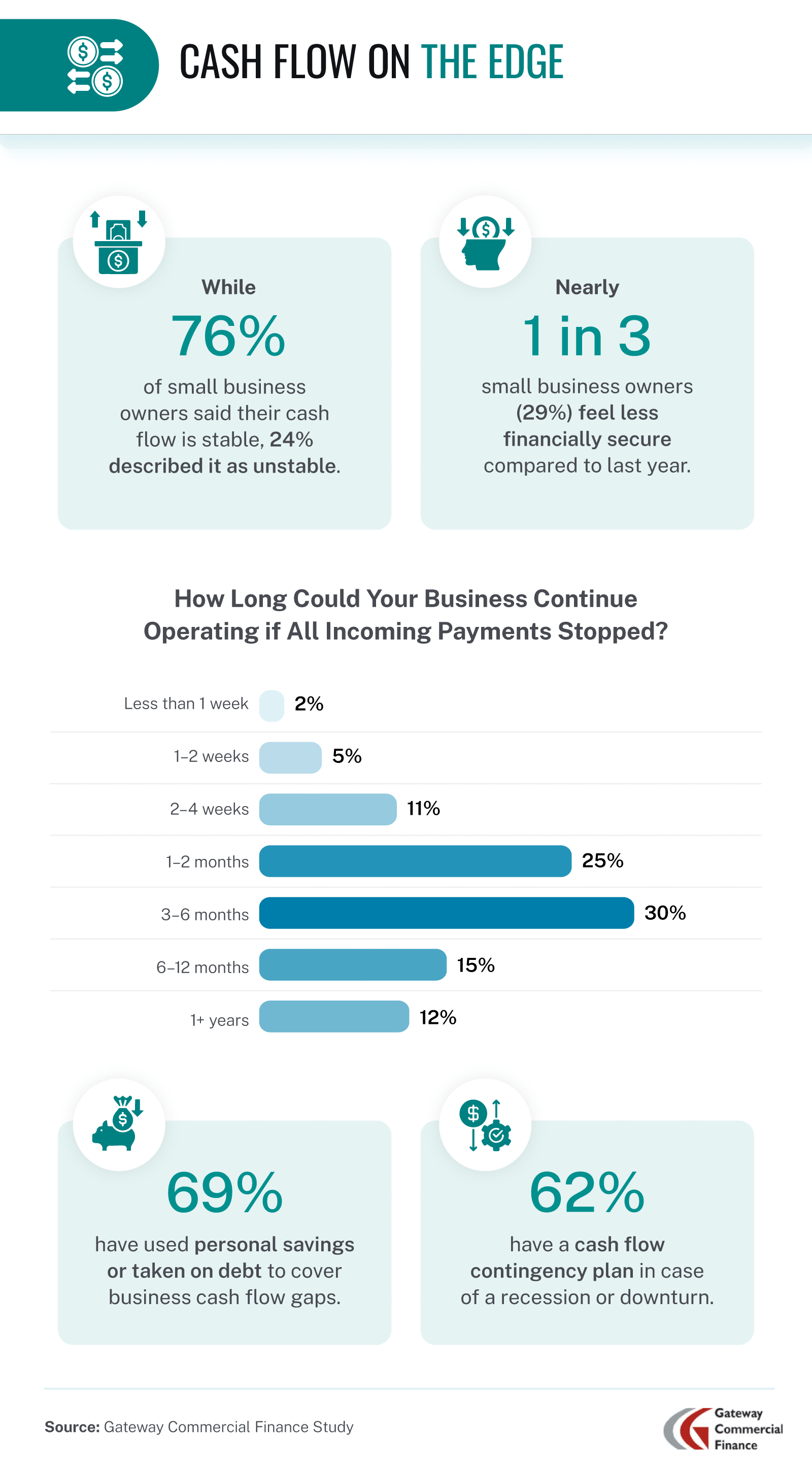

- Nearly 1 in 3 small business owners (29%) feel less financially secure now than last year; 24% of them describe their current cash flow situation as unstable.

The Cost of Waiting: How Late Payments Are Holding SMBs Back

Late customer payments can disrupt everything from cash flow to strategic growth. For many business owners, these delays are a nuisance and a serious barrier to staying competitive.

Many small business owners (73%) have noticed invoice delays becoming more common as customers are starting to preserve their own cash, with technology and SaaS leaders reporting it the most at 91%. In many cases, overdue invoices are lingering far beyond the standard net-30 terms. More than 1 in 10 (12%) have waited 120 days or more for an invoice payment in the past year. And 64% reported currently having invoices that are more than 90 days late, accounting for 11% of their revenue.

Slow-moving payments are directly impacting profitability. On average, SMBs estimated losing $39,406 annually due to payment delays. For nearly 1 in 10 small business owners, that figure exceeds $100,000, a staggering loss for any growing company.

Operational delays are another consequence of unpaid invoices. Just over half of business owners (51%) said they’ve had to postpone purchasing equipment or inventory. Others have fallen behind on paying vendors (43%) or even rent and mortgage (34%). These disruptions often lead to missed growth opportunities, with 63% saying late payments have forced them to pass on business expansion in the past year.

Many business owners also hesitate to address the issue head-on. Because they fear damaging the relationship, 60% of owners have avoided confronting late-paying clients. In some cases, the consequences have been dire. Over half (53%) have had to turn away new business opportunities because of cash flow issues tied to late payments.

Running Lean: Cash Flow Concerns Are Rising

When stability depends on predictable income, even minor interruptions in payment timing can tip the scales. Many small business owners are making tough choices to stay ahead.

Even as most small business owners (76%) described their current cash flow situation as stable, a closer look reveals some vulnerability. Nearly 1 in 4 considered their cash flow unstable, and 29% felt less financially secure now than they did a year ago.

Many businesses are only a few slow payments away from a serious crisis. If all payments stopped today, 73% said their company could survive for 6 months or less. That’s a precarious margin.

To make ends meet, 69% have used personal savings or taken on personal debt to support business operations. While 62% said they have a contingency plan for a potential economic downturn, that still leaves a large portion — 38% — unprepared for financial disruption.

Searching for Solutions: How SMBs Are Managing the Gap

Access to working capital is essential, but navigating financing options can be complex and frustrating. Business owners are weighing risks, costs, and long-term impacts as they explore ways to bridge cash flow gaps.

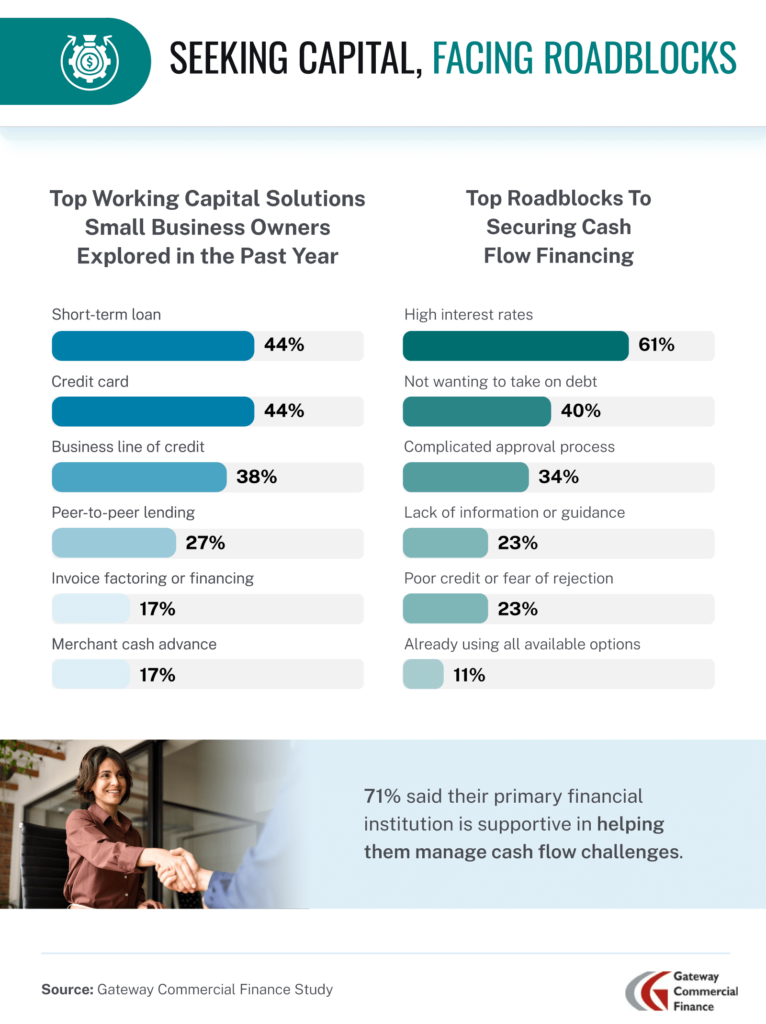

Many business owners are exploring financing options to keep operations running smoothly despite late customer payments. They most often considered short-term loans (44%), credit cards (44%), and business lines of credit (38%) in the past year. About 1 in 6 have also looked into invoice factoring, which allows businesses to unlock working capital by selling unpaid invoices, and merchant cash advances.

High interest rates (61%), debt concerns (40%), and complex approvals (34%) remain major barriers for small business owners seeking traditional funding. However, 71% of small business owners said their primary bank is supportive when it comes to managing cash flow challenges.

Conclusion

Late payments are making it harder for small businesses to grow, plan ahead, or even keep the lights on. Business owners are starting to rethink how they manage these delays. Many are exploring faster, more flexible funding options to keep things running smoothly. The goal is to stay prepared, no matter how unpredictable payments become. In a challenging economy, having the right tools can help a business stay focused and move forward with confidence.

Methodology

For this study, we surveyed 503 small business owners about their experiences with late payments and how they have affected their business operations. The majority (92%) operated a business with 100 or fewer employees. Industry-wise, 22% worked in retail or e-commerce, 18% in professional services, 13% in technology or SaaS, 11% in healthcare, and 36% in another industry.

A limitation of this study is its reliance on self-reporting; the data reported is based on the responses of the small business owners surveyed.

About Gateway Commercial Finance

Gateway Commercial Finance helps small and mid-sized B2B companies solve cash flow challenges caused by slow-paying customers. As a trusted invoice factoring company, Gateway offers fast, flexible funding to help businesses cover payroll, purchase inventory, and pursue growth opportunities without taking on new debt. Learn more about how invoice factoring can strengthen your working capital strategy today.

Fair Use Statement

If you’d like to share or reference the findings from this article, you’re welcome to do so for noncommercial purposes. Please include a link back to Gateway Commercial Finance for proper attribution.