Net 30 means a customer has 30 calendar days from the invoice date to make full payment. It can be a useful tool for small business owners managing customer payments and cash flow. This common credit term used in B2B transactions gives clients flexibility while helping businesses maintain steady trade credit relationships.

Net 30 terms can help build trust, encourage repeat business, and support predictable revenue. In this article, we’ll break down how net 30 works, who should offer it, the pros and cons, and best practices for managing it effectively.

Pros and Cons of Offering Net 30

Offering net terms is a strategic way for small business owners to stay competitive, but it’s not without risks. Weighing the benefits and drawbacks can help you decide if these credit terms align with your payment policies and business needs.

Pros of offering net 30 terms include:

- Attracting new customers. Flexible terms can appeal to buyers who prefer not to pay upfront.

- Building customer loyalty. Providing credit shows trust, which can lead to stronger, long-term relationships.

- Supporting timely payments. When clearly stated, a structured payment period helps set expectations and reduce confusion.

- Aligning with business needs. For many B2B clients, net 30 fits seamlessly into their monthly budgeting cycles.

Cons of net 30 terms to consider are:

- Tightening cash flow. Delayed payments can make it harder to cover your own expenses.

- Increasing overdue invoices. Some clients may miss the deadline, even with clear terms in place.

- Adding follow-up work. You’ll need systems for tracking accounts and following up with slow payers.

- Straining new or smaller businesses. Companies with limited reserves or inconsistent income may find net 30 unsustainable.

How To Qualify Businesses for Net 30 Terms

If you’re a small business owner considering whether to offer deferred payment terms such as net 30 to your customers, it’s important to first confirm that your business is financially prepared. Offering trade credit means accepting delayed payments, so you’ll need solid systems in place to manage that risk. These tips will help ensure your business is ready to extend net 30 terms safely and effectively:

- Review your business credit. Strong credit reporting and a reliable payment history signal that your operations are financially stable enough to handle delayed revenue.

Evaluate your credit score. A higher score supports your ability to absorb payment delays and reflects well on your financial health. - Define credit limits. Establish limits based on your cash reserves, customer type, and typical order values to avoid overextending your resources.

- Screen new businesses carefully. If a customer is just getting started, look at other indicators—like industry experience or personal credit—to assess reliability.

- Build business credit before offering terms. If your company is new, focus first on building a credit profile before taking on the risk of net 30 accounts.

- Use credit reporting tools. Monitor customer behavior and flag late payers before they become cash flow liabilities.

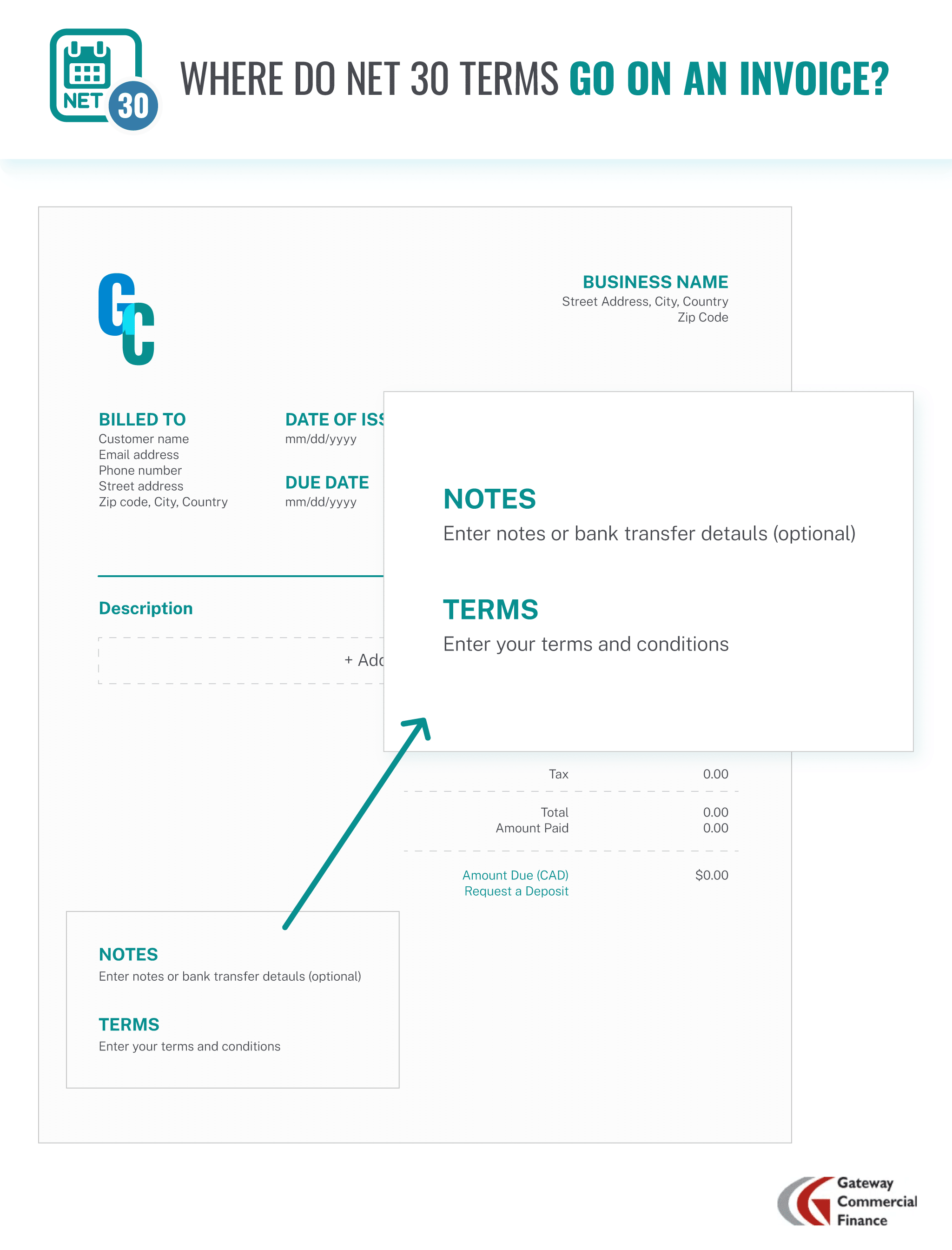

Where To Put Net 30 on an Invoice

Clear communication helps prevent late payments, and that starts with the invoice. Always include “net 30” prominently near the invoice total or due date, so your customer knows exactly when payment is expected.

Modern accounting software can automate this detail by setting default payment terms across all invoices. This not only saves time but ensures consistency. Automating invoice payment terms also minimizes disputes and keeps your team aligned on expectations.

When Net 30 Makes Sense — and When It Doesn’t

Offering net 30 terms can be a smart strategy, but only under the right conditions. These credit terms aren’t a good fit for every small business or customer relationship. Use the lists below to evaluate when offering net 30 aligns with your payment policies and risk tolerance.

Net 30 makes sense when:

- You work with established B2B clients. Customers with a solid credit score and long-standing payment history are more likely to pay on time.

- You’ve built strong customer relationships. Trustworthy, repeat clients are usually reliable with their payments and understand trade credit expectations.

- Your cash flow is stable. Businesses with predictable revenue or access to a line of credit can afford to wait for incoming payments.

- You have systems for tracking payments. If your accounting software can automate payment periods and send reminders, you’re less likely to run into issues.

- You’re offering short-term flexibility. When structured well, net 30 terms can serve as a competitive edge without hurting your margins.

Net 30 doesn’t usually make sense when:

- You’re dealing with new clients. First-time buyers or startups often lack the payment history to justify extended terms.

- Your cash flow is tight. If you rely on immediate income to cover operations, waiting 30 days could disrupt your business.

- You don’t have a follow-up process. Without a plan for chasing overdue invoices, late payments can pile up quickly.

- Your margins are thin. Smaller businesses with limited reserves may not recover easily from late or missed payments.

- You’ve experienced frequent late payments. Past issues with payment terms suggest net 30 may not align with your current client base.

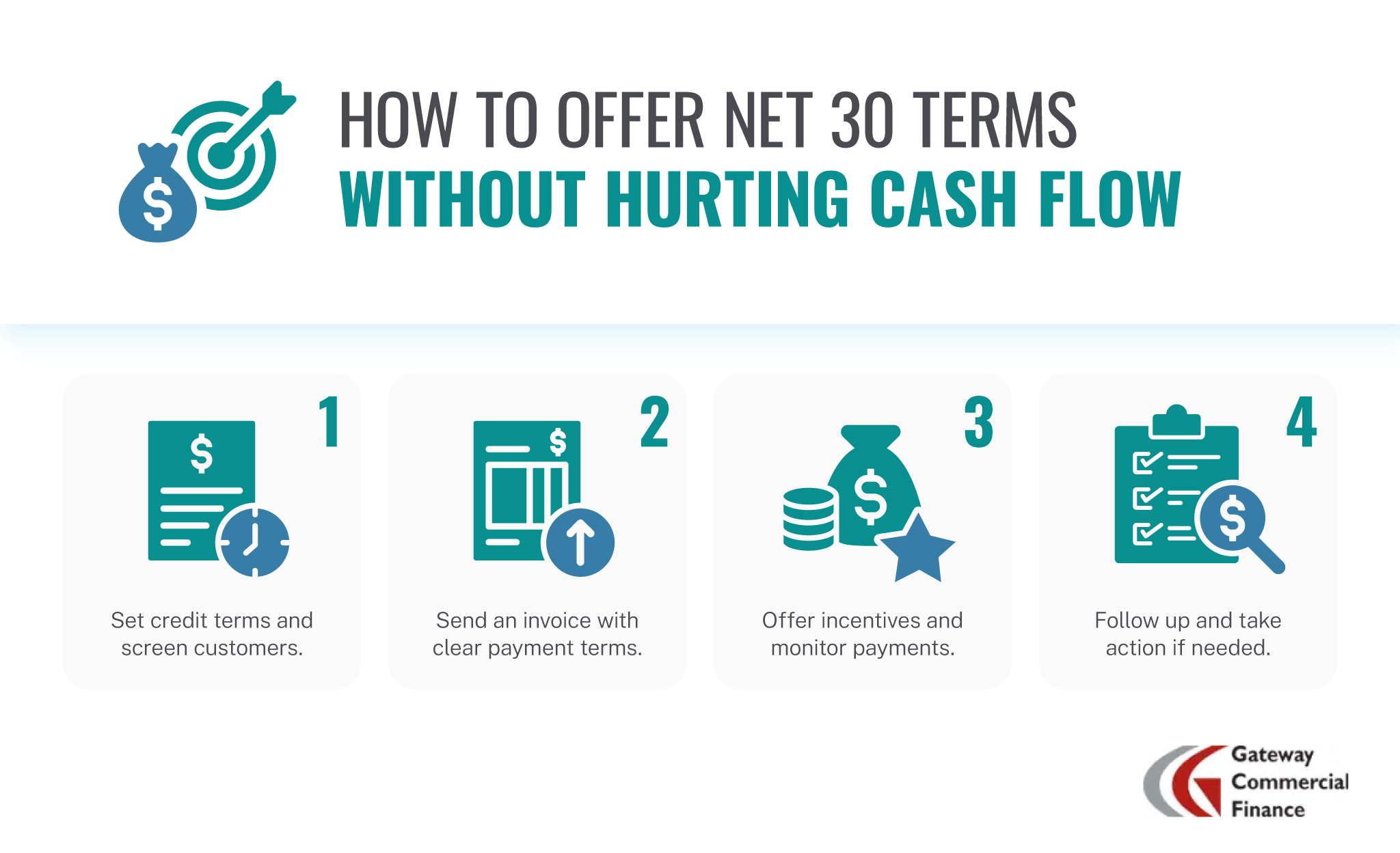

Best Practices for Managing Net 30 Terms

Net 30 terms can help close deals and build strong B2B relationships, but they also tie up cash that some smaller businesses can’t afford to lose for 30 business days or more. Late payments can quickly lead to cash flow problems, especially when payroll, vendor costs, and growth initiatives are on the line.

The following practices can help protect your operations while offering flexible terms to trusted clients.

Use Tiered Pricing Based on Payment Terms

Charging more for slower payment options creates a built-in incentive for clients to pay quickly. For example:

- Net 7: no markup

- Net 14: add 2%

- Net 30: add 3%

- Net 60: add 5%

- Net 90: add 10%

This pricing structure rewards prompt payers and gives you margin flexibility to support options like invoice factoring if needed. If a customer selects a longer term and pays a premium, you now have the budget to smooth out cash flow with a financing partner, without taking on traditional debt.

Offer Early Payment Discounts

Encouraging customers to pay sooner with a modest discount can improve your cash position without involving a lender. A common example is 1-2% off if payment is made within 10 days. While it reduces the total invoice amount slightly, the benefit of predictable cash flow often outweighs the cost.

For example, if you issue a $1,000 invoice with “1/10 net 30” terms, your customer can pay just $990 ($1,000 minus 1%) if they submit payment within 10 calendar days. Otherwise, the full $1,000 is due within 30 days.

This gives clients flexibility to manage their own cash flow while helping your business get paid faster.

Follow Up on Overdue Invoices Early and Often

Don’t wait until an invoice is 30 days overdue to check in. Send a reminder a few days before the due date, and continue following up regularly until payment is received. A structured process with timely communication makes late payments less likely and helps you identify customers with recurring issues.

If a customer still hasn’t paid after multiple follow-ups, consider escalating your response. Resend the invoice with late fees added (if allowed by your credit terms), or temporarily pause new orders until the balance is paid.

Need ready-to-send email language for every stage of the net 30 payment cycle? We’ve put together five follow-up templates—from gentle reminders to final notices—that you can copy, paste, and customize:

Download the Follow-Up Email Template Pack (PDF)

Stay professional, consistent, and on top of overdue invoices without starting from scratch.

Use Invoice Factoring To Fill Payment Gaps

Even with structured payment terms and proactive follow-up, some clients will still pay late, and that delay can put stress on your operations. If you’re consistently waiting too long for payment, invoice factoring can offer much-needed relief.

Factoring allows your business to sell unpaid invoices to a third party—known as a factor—in exchange for a percentage of the invoice amount up front, often within one to two business days. Once the client pays the invoice in full, the remaining balance (minus a fee) is paid to you.

This solution is especially useful for smaller businesses that invoice other businesses and need a reliable way to stabilize cash flow without taking on additional debt. Factoring can also help cover short-term needs like payroll, rent, or equipment purchases when revenue is locked up in unpaid invoices.

If late payments are affecting your ability to meet business needs, invoice factoring is a practical way to unlock working capital without waiting for clients to catch up.

Shorten Billing Cycles as Needed

Net 30 doesn’t work for every business; some may want to reduce risk by changing how frequently they bill. One Reddit user described how they tackled chronic delays:

“The last two years I’ve watched my [accounts receivable] over 30 explode. For many longstanding customers, we’ve gone down to a net 10 or 15 because they were stringing us out 45-60. I’ve changed a lot of my billing practices to weekly instead of monthly. This isn’t industry-specific; it’s across the board. Everybody is hurting and slow to pay right now.”

Moving from monthly to weekly billing or offering shorter payment terms for repeat offenders can help businesses meet their obligations without incurring new debt.

Is Net 30 Right for Your Business?

Net 30 terms can make your services more competitive, but they also create risk. Before extending credit to a customer for 30 business days, evaluate whether your business can absorb the delay.

Consider your available cash reserves, payroll schedule, supplier payments, and how reliably your clients have paid in the past. If you don’t have strong working capital or if cash flow is already tight, net 30 may not be a fit, especially for new customers or clients with unclear payment history.

Invoice factoring can be a practical short-term solution for businesses that need more immediate payment. It lets you unlock the value of unpaid invoices without taking out a loan.

Visit Gateway Commercial Finance to explore how invoice factoring can help your business stay on track.

FAQs

Is Net 30 Standard?

Yes. Net 30 is a common payment term in B2B contracts, giving the buyer 30 calendar days from the invoice date to pay in full.

How Is Net 30 Calculated?

It’s typically calculated from the invoice date, unless otherwise agreed. Always specify this clearly on your invoice.

Can New Businesses Offer Net 30?

They can, but it comes with risk. Without strong reserves or client vetting processes, new businesses may struggle to absorb late payments. Consider shorter terms or deposits instead.

Is Net 30 From the Invoice Date or Delivery Date?

By default, net 30 begins on the invoice date. If your client expects it to start after delivery, clarify that in writing.

What if a Customer Doesn’t Pay on Time?

Set clear terms in advance, including late fees, interest, or service suspension. If payment is delayed, follow up promptly and escalate if needed. Tracking payment history helps avoid repeat issues.

Is Net 30 Legal?

Yes. Net 30 is a legal and widely accepted payment term in the United States. It’s a core part of many small business owners’ accounts receivable processes. While not paying on time doesn’t violate the law, it can lead to late fees, collections activity, and eventually bad debt. The key is having clear terms, documentation, and follow-through on enforcement.

Net 30, Net 15, Net 60, and Net 90: What’s the Difference?

These terms represent different payment windows, calculated from the invoice date. Shorter payment terms (such as net 15) improve cash flow and reduce risk. Longer terms (such as net 90) may be appropriate for large or long-term contracts, but they require careful planning and possibly the use of cash flow tools like invoice factoring.