Every business closure tells a story, and many of them have common threads. To better understand where things go wrong, we surveyed 213 former small business owners who either sold or shut down their companies. Their answers reveal the warning signs they missed, the funding avenues they overlooked, and the lessons they’re carrying into their next ventures. If your business is facing financial pressure or scaling hurdles, these insights may help you avoid the same fate.

Key Takeaways

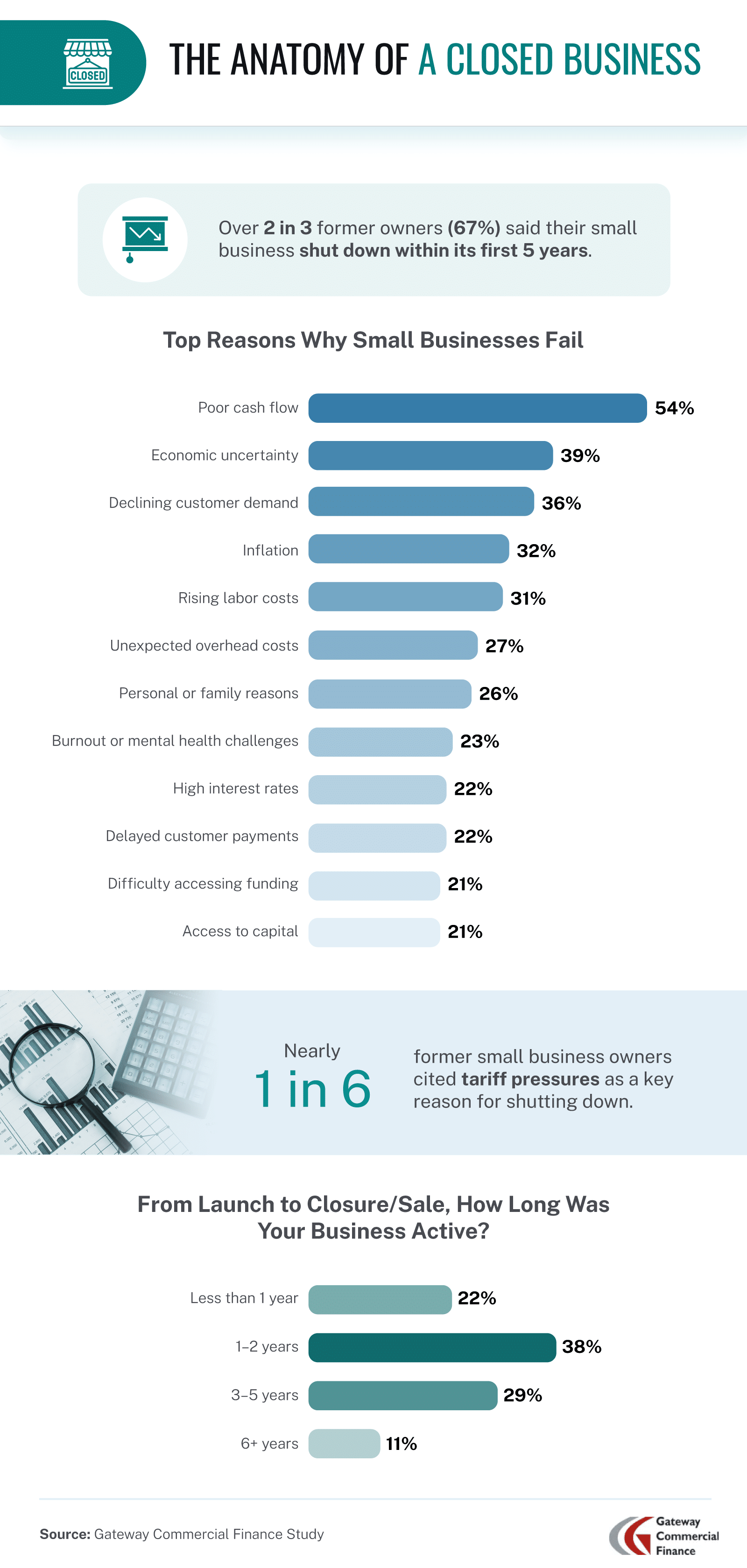

- Over 2 in 3 businesses (67%) shut down within their first 5 years.

- Nearly 1 in 6 former small business owners cited tariff pressures as a key reason for shutting down.

- More than half (54%) ignored red flags for 3 to 6 months before accepting their business was failing.

- Small business loans were the most explored funding tool (47%), but many wish they had pursued grants (27%) or credit lines (21%) sooner.

- Despite their setbacks, 64% would start another company. The concept of “vibe coding” has sparked a renewed interest in entrepreneurship, with 51% of former owners saying it has inspired them to try again.

Top Reasons Former Owners Shut Down Their Business

Business failure is rarely sudden. For many former owners, the cracks started forming early. A staggering 67% of businesses closed within their first five years, underscoring just how vulnerable the early stages can be, especially without the right support or capital cushion.

Beyond financial strain, operational and emotional hurdles also played a major role. Over half of respondents (52%) said a lack of support or advice was one of their biggest challenges, while 40% struggled with hiring, time management, and burnout. These internal issues can worsen external pressures, making it harder to pivot or scale effectively.

Tariff pressures also emerged as a surprising culprit, with nearly 1 in 6 former owners citing them as a key factor in their decision to close. Whether through rising import costs or unpredictable supply chain disruptions, global trade dynamics proved too difficult to weather for many small businesses.

Perhaps most notably, 82% of respondents said they struggled for at least 3 months before deciding to shut down or sell, which proves that many tried to hang on longer than was financially healthy.

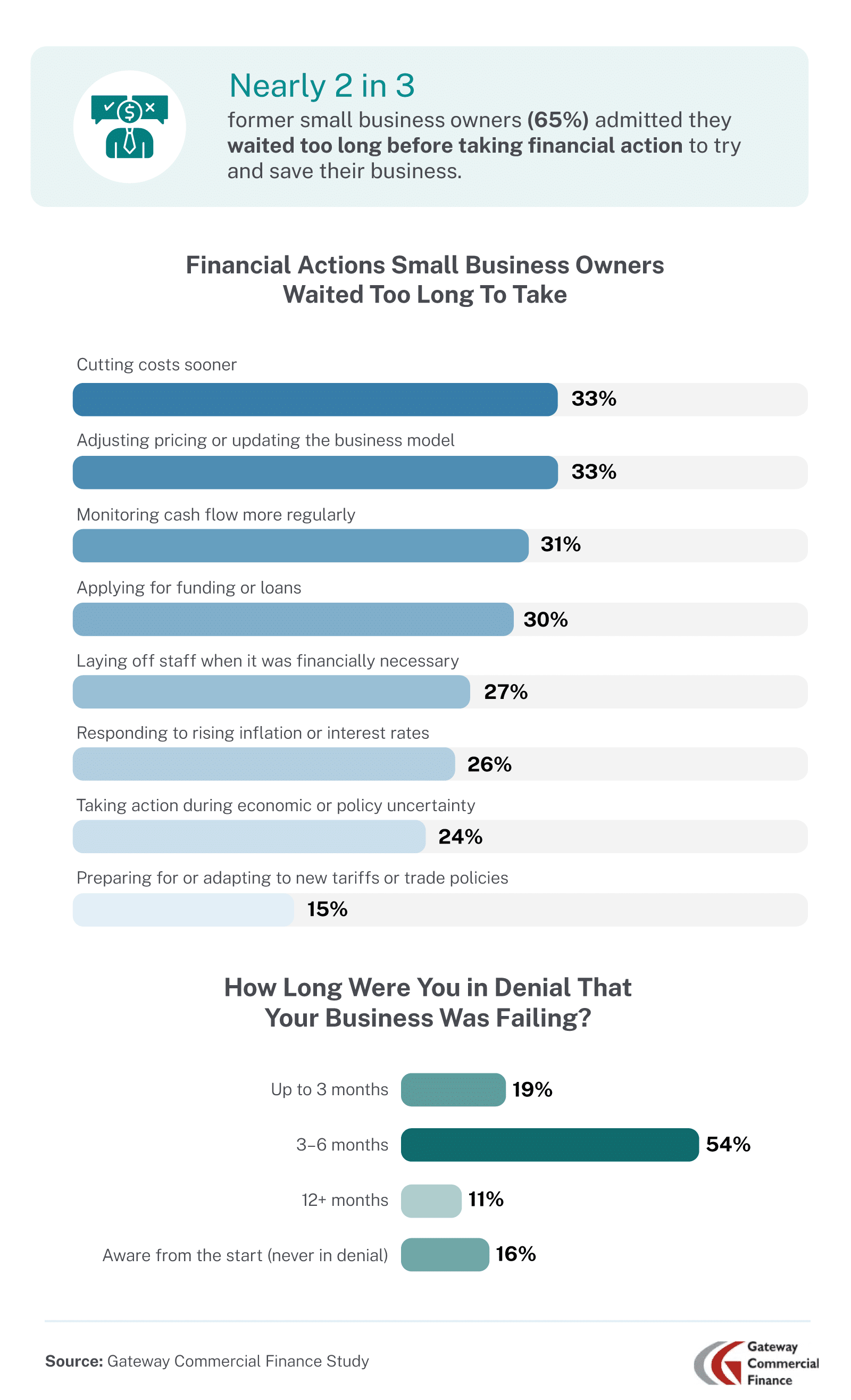

Sometimes, failure comes not from what business owners didn’t see, but from what they chose to ignore. More than half (54%) admitted they overlooked red flags for 3 to 6 months, often hoping the situation would turn itself around. Former business owners who were never in denial about their company’s struggles tended to stay in business longer, with 29% remaining open for over 5 years.

Delays in decision-making had real consequences. Sixty-five percent said they postponed critical financial choices, such as cutting costs or updating their business model (both of which were cited by 33% of respondents).

Missed financial vigilance was another common regret. About one-third of owners failed to monitor cash flow regularly (31%) or waited too long to apply for funding (30%). These gaps can turn manageable problems into irreversible setbacks.

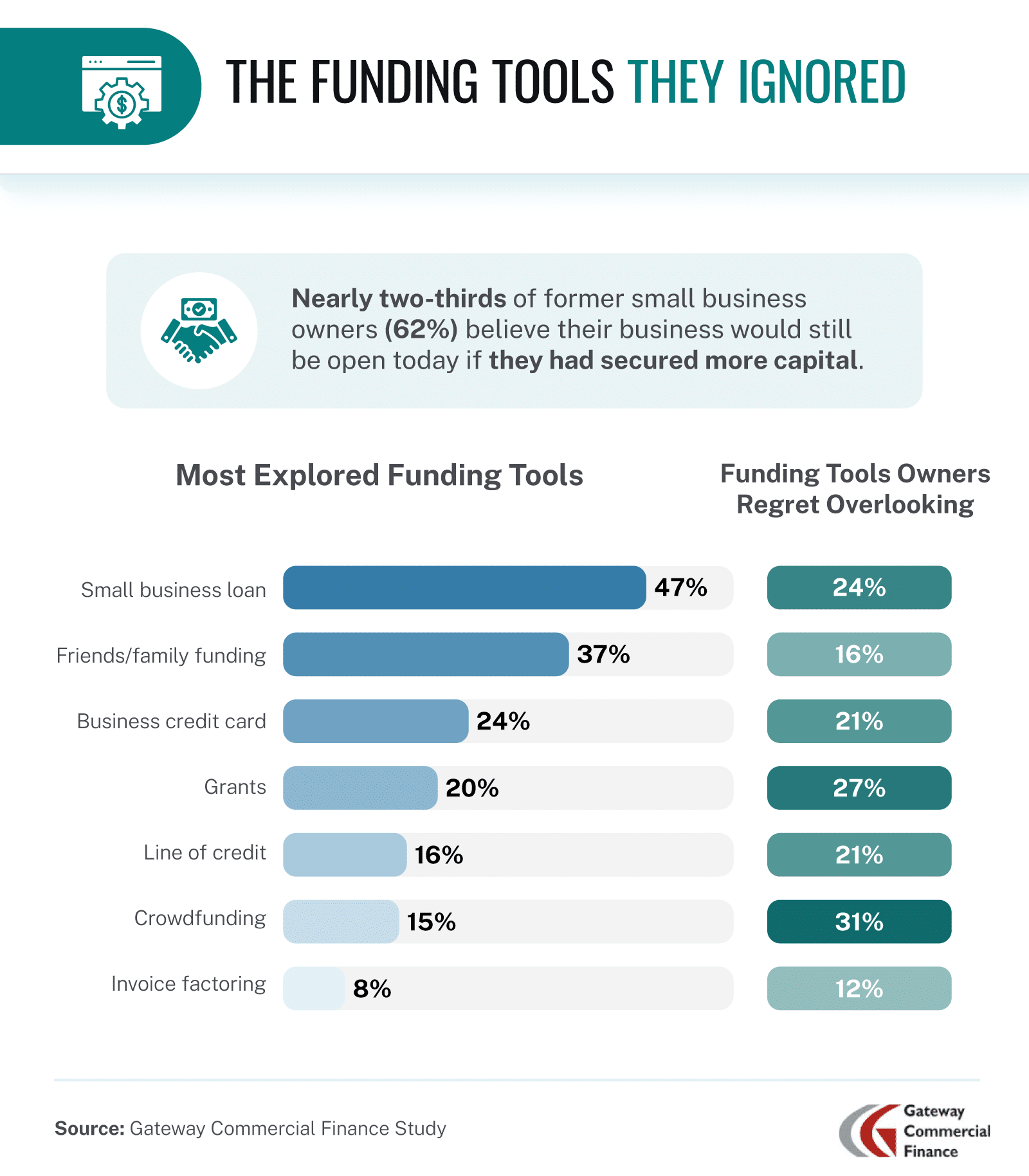

The Funding Tools Business Owners Regret Overlooking

Access to capital didn’t just impact survival. It could have changed the outcome entirely.

Nearly two-thirds of former small business owners (62%) believe their companies would still be operating today if they had secured more funding. While small business loans were the most commonly explored option (47%), many respondents said they wished they had acted sooner on other tools.

Grants (27%) and business lines of credit (21%) were two of the most overlooked resources, yet both could have provided much-needed flexibility during tight periods. More than 1 in 10 (12%) regretted not taking advantage of invoice factoring, a financing method where a business sells its unpaid invoices to a third party at a discount to improve cash flow.

Crowdfunding also stood out as a particular missed opportunity. Only 15% tried it, but among those who didn’t, nearly one-third (31%) wished they had. This suggests there’s room for greater awareness and education around nontraditional funding paths.

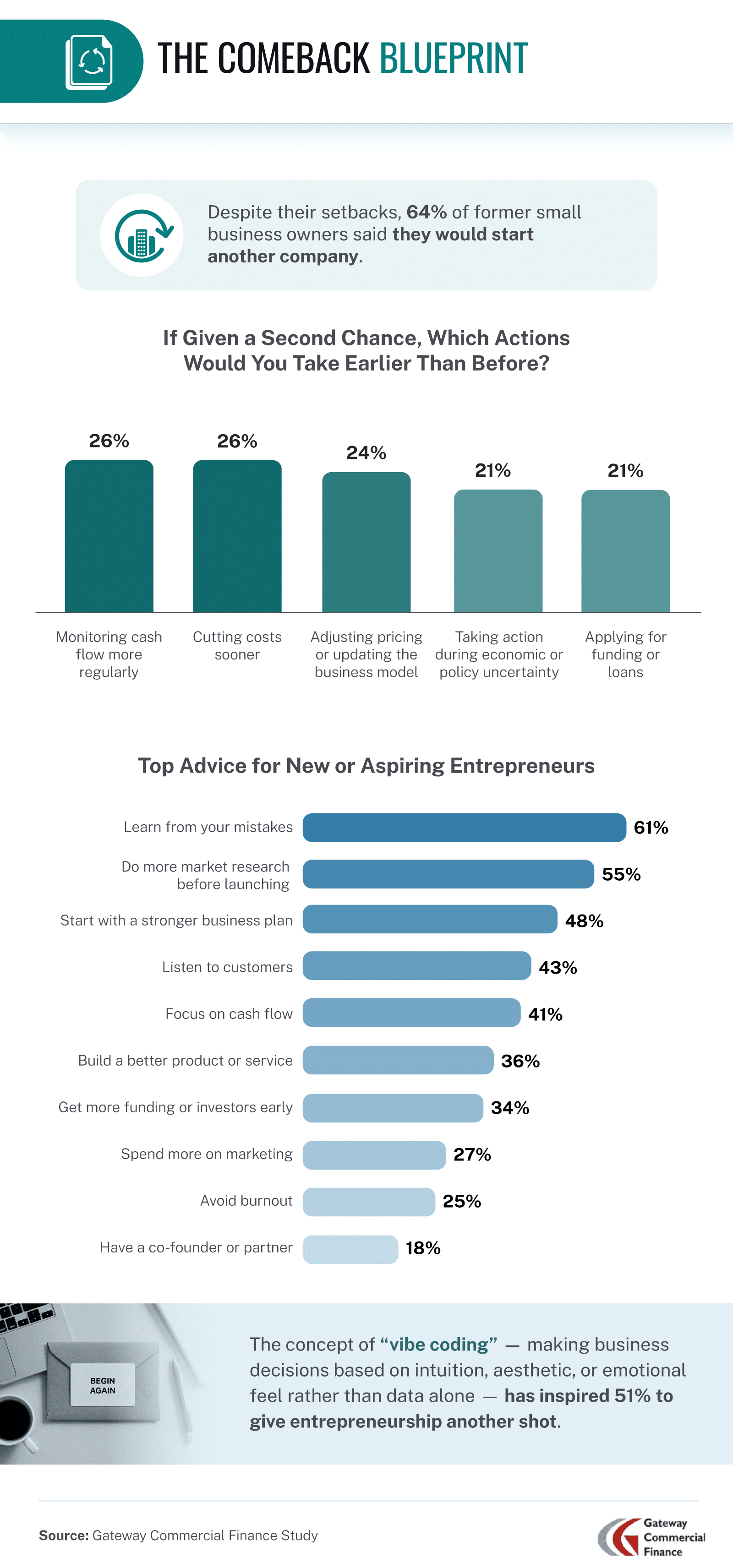

Would You Try Again?

Despite their challenges, the entrepreneurial spirit remains strong among former small business owners. Many (64%) said they would start another company, proving that failure isn’t always final and that it often becomes foundational.

Experience has turned into wisdom for many. More than 3 in 5 respondents (61%) said their top advice for future entrepreneurs is to learn from past mistakes. Whether it’s better financial oversight, staffing decisions, or knowing when to ask for help, the lessons they gained now fuel smarter strategies.

One unexpected motivator for former founders? A trend called “vibe coding.” It’s a growing mindset in startup and creative circles, where entrepreneurs use intuition and personal values—often with AI and design tools—to build products, brands, and businesses that feel authentic, not just data-driven. More than half (51%) said this mindset has reignited their interest in starting a new venture, and it’s changing how they plan to approach business moving forward.

Small Business Owners Share Hard Lessons

This study reveals how often small business closures stem from preventable delays, overlooked funding options, and internal misalignment. But it also highlights something more powerful: resilience. The majority of former owners aren’t just reflecting on past issues. They’re rebooting, better equipped for what’s next. If your business is facing challenges today, their hindsight might just be your foresight.

Methodology

We surveyed 213 former small business owners who have sold or closed a business they founded. The data was collected in April 2025.

About Gateway Commercial Finance

Gateway Commercial Finance helps small to mid-sized B2B companies overcome cash flow hurdles with fast, flexible funding solutions like invoice factoring. Whether you’re managing payroll, supplier costs, or recovering from financial setbacks, Gateway offers dependable capital when you need it most.

Fair Use Statement

We welcome the use of this data and insights for noncommercial purposes. If you share any part of this article, please include a link back to Gateway Commercial Finance with proper attribution.