What Are Factoring Rates… and What Will They Cost You?

An invoice factoring rate is the discount rate applied to invoices when a company sells them to a factor — a process known as receivable factoring. It reflects the cost of turning your unpaid invoices into immediate cash flow.

Historical Factoring Rates

Displayed below is our up-to-date list of daily invoice factoring rates from the past 90 days, refreshed daily for accuracy. (*)

Date: 02/12/2026, Rate: 0.03%

Date: 02/11/2026, Rate: 0.03%

Date: 02/10/2026, Rate: 0.03%

Date: 02/09/2026, Rate: 0.03%

Date: 02/06/2026, Rate: 0.03%

Date: 02/05/2026, Rate: 0.03%

Date: 02/04/2026, Rate: 0.03%

Date: 02/03/2026, Rate: 0.03%

Date: 02/02/2026, Rate: 0.03%

Date: 01/30/2026, Rate: 0.03%

Date: 01/29/2026, Rate: 0.03%

Date: 01/28/2026, Rate: 0.03%

Date: 01/27/2026, Rate: 0.03%

Date: 01/26/2026, Rate: 0.03%

Date: 01/23/2026, Rate: 0.03%

Date: 01/22/2026, Rate: 0.03%

Date: 01/21/2026, Rate: 0.03%

Date: 01/20/2026, Rate: 0.03%

Date: 01/16/2026, Rate: 0.03%

Date: 01/15/2026, Rate: 0.03%

Date: 01/14/2026, Rate: 0.03%

Date: 01/13/2026, Rate: 0.03%

Date: 01/12/2026, Rate: 0.03%

Date: 01/09/2026, Rate: 0.03%

Date: 01/08/2026, Rate: 0.03%

Date: 01/07/2026, Rate: 0.03%

Date: 01/06/2026, Rate: 0.03%

Date: 01/05/2026, Rate: 0.03%

Date: 01/02/2026, Rate: 0.03%

Date: 12/31/2025, Rate: 0.03%

Date: 12/30/2025, Rate: 0.03%

Date: 12/29/2025, Rate: 0.03%

Date: 12/26/2025, Rate: 0.03%

Date: 12/24/2025, Rate: 0.03%

Date: 12/23/2025, Rate: 0.03%

Date: 12/22/2025, Rate: 0.03%

Date: 12/19/2025, Rate: 0.03%

Date: 12/18/2025, Rate: 0.03%

Date: 12/17/2025, Rate: 0.03%

Date: 12/16/2025, Rate: 0.03%

Date: 12/15/2025, Rate: 0.03%

Date: 12/12/2025, Rate: 0.03%

Date: 12/11/2025, Rate: 0.03%

Date: 12/10/2025, Rate: 0.03%

Date: 12/09/2025, Rate: 0.03%

Date: 12/08/2025, Rate: 0.03%

Date: 12/05/2025, Rate: 0.03%

Date: 12/04/2025, Rate: 0.03%

Date: 12/03/2025, Rate: 0.03%

Date: 12/02/2025, Rate: 0.031%

Date: 12/01/2025, Rate: 0.031%

Date: 11/28/2025, Rate: 0.031%

Date: 11/26/2025, Rate: 0.031%

Date: 11/25/2025, Rate: 0.031%

Date: 11/24/2025, Rate: 0.03%

Date: 11/21/2025, Rate: 0.03%

Date: 11/20/2025, Rate: 0.03%

Date: 11/19/2025, Rate: 0.03%

Date: 11/18/2025, Rate: 0.03%

Date: 11/17/2025, Rate: 0.031%

Date: 11/14/2025, Rate: 0.03%

Date: 11/13/2025, Rate: 0.031%

Date: 11/12/2025, Rate: 0.031%

Date: 11/10/2025, Rate: 0.03%

Date: 11/07/2025, Rate: 0.03%

Date: 11/06/2025, Rate: 0.03%

Date: 11/05/2025, Rate: 0.03%

Date: 11/04/2025, Rate: 0.031%

Date: 11/03/2025, Rate: 0.031%

Date: 10/31/2025, Rate: 0.031%

Date: 10/30/2025, Rate: 0.031%

Date: 10/29/2025, Rate: 0.031%

Date: 10/28/2025, Rate: 0.031%

Date: 10/27/2025, Rate: 0.031%

Date: 10/24/2025, Rate: 0.031%

Date: 10/23/2025, Rate: 0.031%

Date: 10/22/2025, Rate: 0.031%

Date: 10/21/2025, Rate: 0.031%

Date: 10/20/2025, Rate: 0.031%

Date: 10/17/2025, Rate: 0.031%

Date: 10/16/2025, Rate: 0.031%

Date: 10/15/2025, Rate: 0.031%

Date: 10/14/2025, Rate: 0.031%

Date: 10/10/2025, Rate: 0.031%

Date: 10/09/2025, Rate: 0.031%

Date: 10/08/2025, Rate: 0.031%

Date: 10/07/2025, Rate: 0.031%

Date: 10/06/2025, Rate: 0.031%

Date: 10/03/2025, Rate: 0.031%

Date: 10/02/2025, Rate: 0.031%

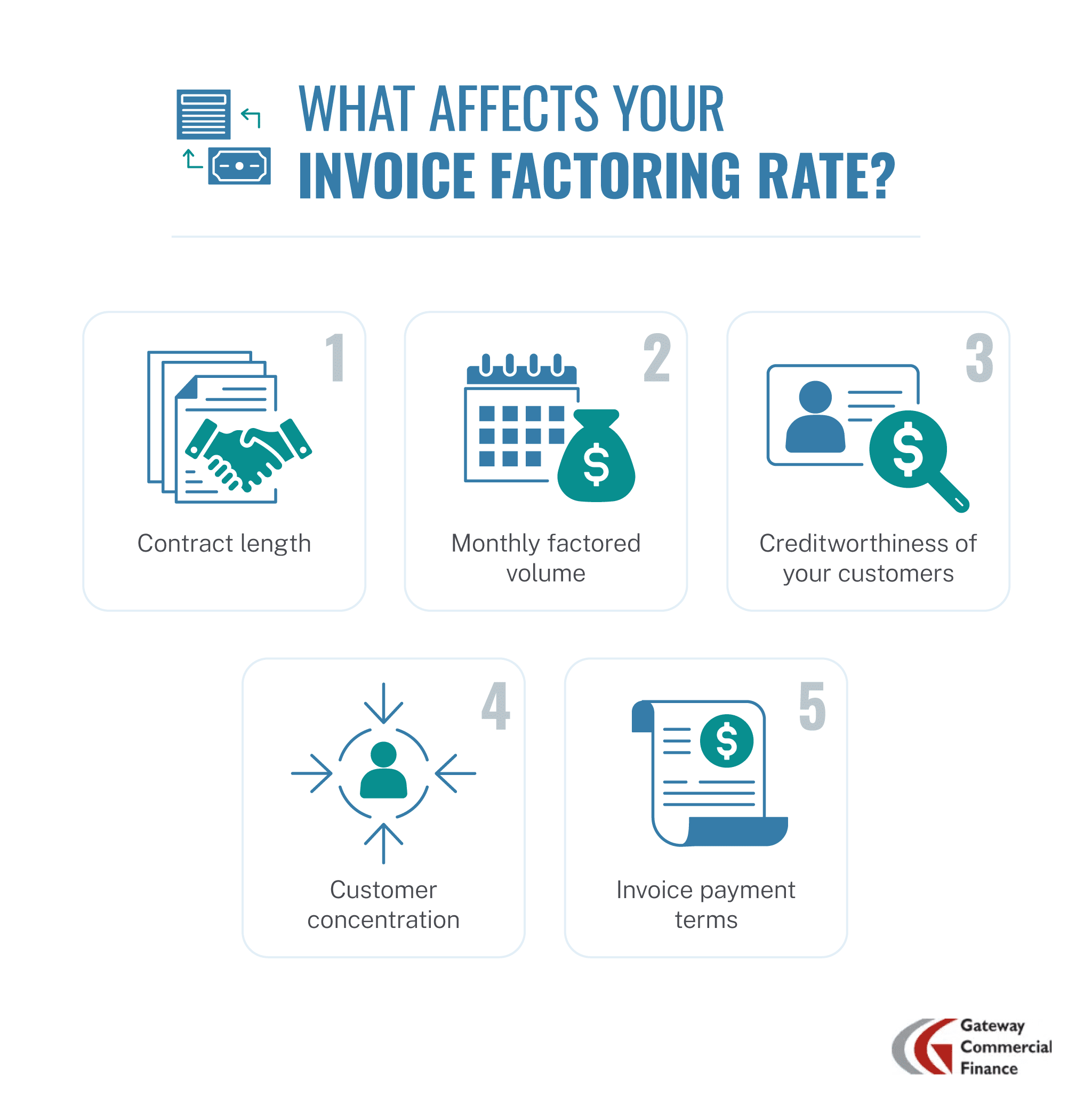

What Impacts the Invoice Factoring Rate That Your Company Can Get?

When applying for invoice factoring, several key factors influence the cost of invoice financing. Understanding these elements of factoring fees can help you weigh invoice factoring cost comparisons and qualify for the most competitive pricing.

1. Contract Length

Factoring rates are often lower for businesses that commit to a longer-term agreement (e.g., 12 months). Shorter contracts may have higher rates and cost of factoring due to increased risk (lower volume or revenue) for the invoice factoring company.

2. Monthly Factored Volume

Businesses with a higher monthly volume of invoices (e.g., $500,000 or more) typically receive better rates based on their sales volume. If your monthly volume is lower, you may see slightly higher fees.

3. Creditworthiness of Your Customers

The financial strength of your customers (debtors) plays a significant role in determining your rate. Factoring companies perform a credit check to assess credit score and credit history, and tend to prefer debtors with strong credit ratings (e.g., rated by agencies like Dun & Bradstreet). If your customers have weaker credit, your rate may be adjusted accordingly.

4. Customer Concentration

A diversified customer base helps reduce the risk associated with your accounts receivable and outstanding invoices. Your rate may be higher if many of your invoices come from just one or two customers. For example, if one customer represents more than 20% of your invoices, the risk increases, potentially leading to higher costs.

5. Invoice Payment Terms

Factoring companies offer better rates for businesses with shorter payment terms. For instance, invoices with Net 30 payment terms will typically receive lower rates than those with Net 60 or longer terms, as extended payment cycles increase financial risk related to invoice values and invoice amounts.

What Hidden Fees Might Apply In Determining Invoice Factoring Cost?

Different fee structures exist within invoice factoring agreements, impacting the overall cost of factoring. When evaluating options from various invoice factoring companies, it’s important to understand the true cost.

These primary invoice factoring fees are generally categorized as follows:

- Flat fee. Some factors charge a fixed percentage of the total invoice value, applied regardless of how quickly your customer pays. This provides predictable costing but might be less advantageous if your customers typically pay promptly.

- Variable rates (tiered rates). This is a common rate structure in which the factoring fee increases over time while the invoice remains unpaid. For example, a rate might be 1% for the first 30 days, then increase by a certain percentage every subsequent week or two. This structure incentivizes quicker collections.

Beyond the primary service fees, several other additional fees may impact the total cost of invoice factoring:

- Application fees. Although not standard in the factoring industry, some providers may assess a one-time, upfront application or account setup fee.

- Service fees. These periodic fees cover administrative costs, invoice processing, and account management.

- Termination fees. Some charges are incurred if you end your factoring agreement before the agreed-upon term.

- Credit check fees. You may be charged for the factor to assess the creditworthiness of your customers.

- Transaction fees. The cost of invoice factoring may also include charges for transferring funds to your business, such as ACH (Automated Clearing House) or wire transfer fees.

How To Get the Best Invoice Factoring Rate for Your Business

Whether you’re new to factoring or looking to improve your current terms, a few strategic moves can make a big difference:

- Factor higher invoice volumes to qualify for better pricing and improve your working capital.

- Work with strong, creditworthy customers to reduce risk, demonstrating that you serve reliable business owners.

- Diversify your customer base so no single client dominates your revenue, mitigating issues related to customer concentration.

- Maintain shorter payment terms, such as Net 30 instead of Net 60, which can lead to a more attractive flat fee or flat rate.

Meeting these criteria and understanding the nuances of factoring company charges will maximize your chances of receiving the most competitive factoring rate possible. Contact us today to learn more about optimizing your factoring agreement and exploring various fee structures.

Unlock Faster Cash Flow

Gateway Commercial Finance offers flexible factoring services with lines up to $10 million, helping your large or small business improve liquidity and stay focused on growth. Take control of your cash flow and invoice financing today — request your custom factoring quote now and discover how our competitive rates and fast financing options can drive your business forward!

(*)Disclaimer: The advertised daily rate is based on a twelve-month agreement, with minimum monthly purchases of $700,000 from Dun & Bradstreet-rated account debtors holding a 5A3 rating or higher. Debtor concentration must not exceed 15%, and net sales terms cannot exceed Net 30. Final underwriting of the applicant company, its owners/officers/guarantors, and account debtors will be a key factor in any written offer, and the results may influence the terms of any written offer.