Key Takeaways

- Deferred payment terms can boost sales and strengthen customer relationships, but they must be structured carefully to avoid straining your cash flow.

- Not all businesses are suited for deferred payment agreements. Before offering terms, evaluate your financial stability, industry norms, and customer reliability.

- Negotiating and documenting clear payment terms is essential to protect your business legally and ensure timely repayment.

- Invoice factoring and automation platforms can help you manage deferred payments without sacrificing liquidity.

Imagine landing your biggest client yet, only to find out they want 60 days to pay the invoice. Deferred payment terms like these are a common part of doing business, but they can be a double-edged sword. On one hand, they can attract larger clients and encourage more sales; on the other, they can tie up your cash flow and increase risk. Whether you’re new to offering flexible payment terms or reevaluating your current credit policies, it’s important to understand how deferred payment works and when it makes sense.

This article breaks down the structure and function of deferred payment terms, explores their pros and cons, and highlights the industries that use them most. You’ll also learn how to negotiate terms with customers, manage cash flow, and avoid common pitfalls. We’ll even look at how technology and international trade affect these agreements. By the end, you’ll be equipped with practical insights to help you make smarter decisions about offering or accepting deferred payments.

What Are Deferred Payment Terms?

Deferred payment terms are a contractual agreement between two parties in which the buyer (or borrower) agrees to pay the seller (or lender) at a later date, typically 30, 60, or 90 days after receiving goods or services. These are often referred to as Net 30, Net 60, or Net 90 terms and are common in B2B and commercial transactions.

Unlike prepayment models, deferred payments give businesses more flexibility to manage their working capital. The seller delivers the product or service up front, trusting that the buyer will fulfill their obligation by the agreed-upon due date. These terms can vary based on the client’s creditworthiness, the volume of goods or services, or industry standards.

In other contexts — such as student loans, mortgages, or credit card balances — deferred payment terms operate similarly, allowing a borrower to postpone payment for a certain period of time. However, depending on the type of agreement, these usually involve accruing interest or fees. Some financial aid programs even allow students to enroll in a deferred payment plan to avoid making payments while still in school.

How Deferred Payment Terms Work

Understanding how it works is essential for both buyers and sellers. When a deferred payment term is agreed upon, the seller delivers the goods or completes the service and issues an invoice with the due date specified. For example, an invoice may read “Net 30,” meaning the buyer must remit payment within 30 days of the invoice date.

These terms are often established through a deferred payment agreement, which may outline credit limits, penalties for late payments, and any interest or fees that apply if payment is delayed beyond the term.

The buyer typically benefits by gaining time to resell goods or generate revenue, while the seller is taking on the risk of delayed cash flow. In cases of financial hardship or unexpected disruptions, businesses may negotiate extended terms or a deferment period to help manage short-term challenges.

Additionally, many educational institutions and financial aid programs use deferred payment options for tuition, allowing students to avoid immediate payments.

Deferred Payments vs. Installment Plans

It’s important not to confuse deferred payments with installment payment plans. In a deferred arrangement, the buyer pays the full amount at the end of the term. With an installment plan, the payment is split into equal portions over a defined schedule.

For example:

- A deferred payment plan for $12,000 with Net 90 terms means a single $12,000 payment is due in 90 days.

- An installment plan would require three $4,000 payments over 90 days.

Installment plans may include interest or fees, especially when issued by lenders or retailers. Businesses should choose the option that aligns best with their cash flow and customer expectations.

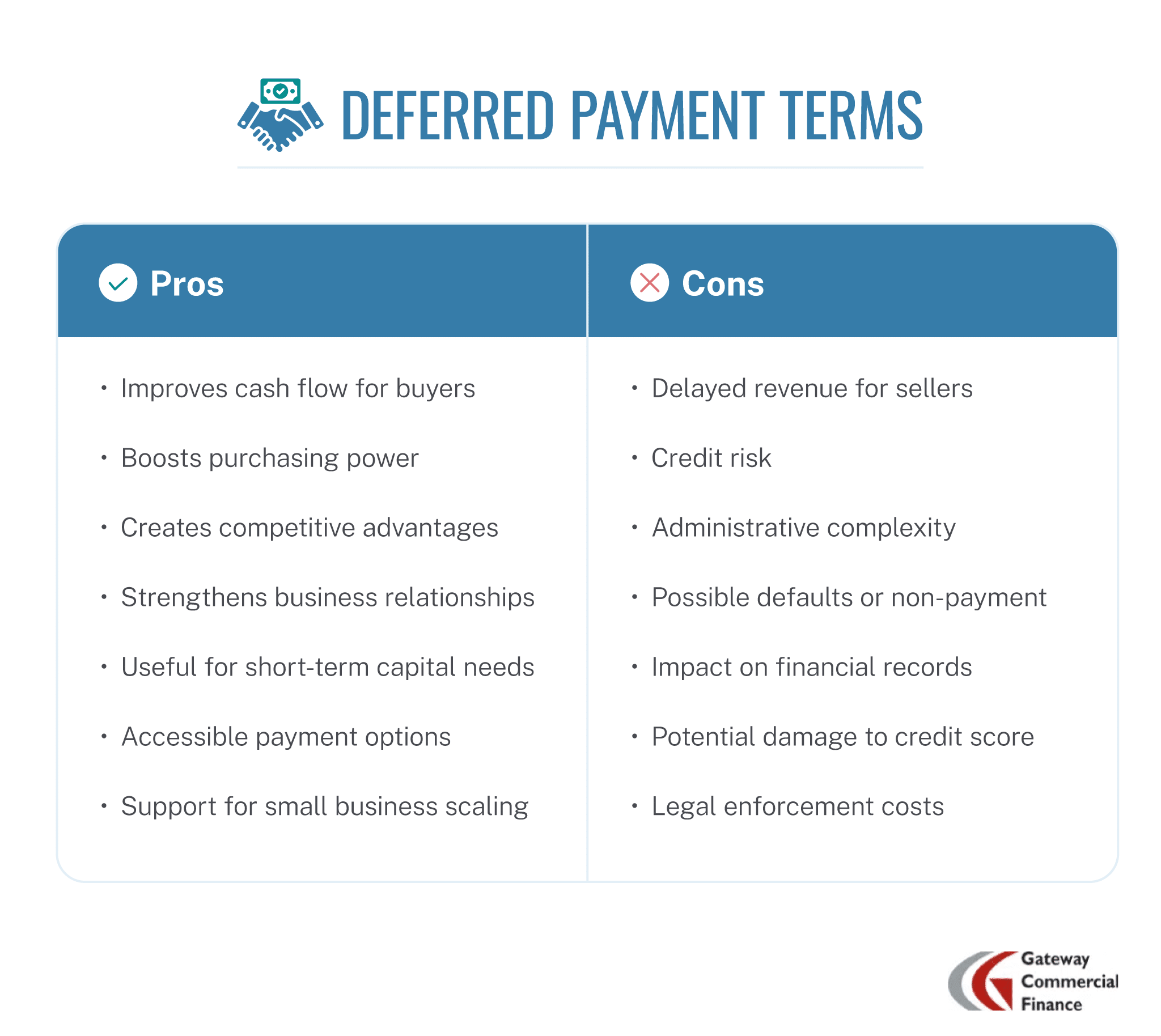

Pros and Cons of Deferred Payment Terms

Below, we break down the benefits and challenges for both parties.

Pros:

- Improves cash flow for buyers. Delaying payment gives buyers more breathing room to manage operations and expenses.

- Boosts purchasing power. Buyers can place larger orders or commit to long-term deals.

- Creates competitive advantages. Sellers offering flexible terms may attract more business.

- Strengthens business relationships. Providing time to pay builds trust with clients, encouraging repeat business.

- Useful for short-term capital needs. When unexpected costs arise, deferred payment terms offer relief without the need to take on new loans.

- Accessible payment options. Businesses may use various methods such as checks, ACH transfers, or wire payments to fulfill deferred agreements.

- Support for small business scaling. Startups and growing companies can use deferred terms to take on new projects without immediate financial strain.

Cons:

- Delayed revenue for sellers. Businesses may struggle to meet their own obligations while waiting for payment.

- Credit risk. Deferred terms require assessing a buyer’s creditworthiness to avoid default.

- Administrative complexity. Monitoring receivables and issuing reminders adds to the workload.

- Possible defaults or non-payment. Missed payments affect cash flow and may require collections or legal follow-up.

- Impact on financial records. Deferred receivables may complicate accounting and budgeting.

- Potential damage to credit score. A missed loan payment or invoice could negatively affect your credit score, especially for smaller businesses or individuals using personal credit lines.

- Legal enforcement costs. Pursuing overdue payments may require legal action, increasing costs.

Risks To Watch Out For

While deferred payment terms offer benefits, they also introduce risk. Watch for these common pitfalls:

- Overextending credit to unreliable customers

- Misalignment between cash inflow and outflow

- Failure to follow up on outstanding invoices

- Legal complications from poorly written agreements

- Inflation or supply chain shocks affecting cost predictability

Sellers can reduce risk by:

- Performing credit checks

- Establishing clear payment expectations

- Offering incentives for early payment

- Limiting the percentage of sales under deferred terms

- Maintaining insurance or reserves for bad debt

Industries That Commonly Use Deferred Payment Terms

Deferred payment terms (also referred to as “extended payment terms” in B2B transactions) are widely used in industries where long sales cycles, project timelines, or large-volume orders are common. Below are examples of sectors where these terms are essential:

- Construction. Contractors often rely on milestone payments throughout a project. A deferred payment plan helps clients manage capital while keeping work on schedule.

- Wholesale and distribution. Buyers may order inventory in bulk and need time to turn it into sales before paying.

- Manufacturing. Factories order raw materials up front and require time to convert them into finished products.

- Staffing agencies. Agencies must cover weekly payroll while waiting 30+ days for clients to pay.

- Transportation and logistics. Operating costs like fuel and labor are incurred before receiving customer payments.

- Non-profit organizations. May have limited access to funds and rely on deferred terms to manage services and operations.

- Education. Universities and trade schools may offer tuition deferment, allowing students to delay payments while pursuing education.

- Healthcare providers. Hospitals and clinics may offer deferred billing to patients or insurance providers for large medical procedures.

These examples show how deferred terms enable smoother business operations, but only when managed with proper financial controls.

Are Deferred Payment Terms Right for Your Business?

While deferred payment terms can be a valuable sales tool, they’re not suitable for every business. In fact, offering deferred terms in the wrong context could lead to cash flow issues, bad debt, or strained customer relationships.

Signs Deferred Payment Terms May Not Be the Right Choice

Watch for these signs that deferred terms may not align with your current operations:

- You’re experiencing frequent cash flow shortages. If you rely on every payment to cover payroll or operational expenses, extending terms may create instability.

- You don’t have systems in place to manage receivables. Without proper invoicing, follow-up, and reporting tools, managing deferred payments can become a burden.

- Customers consistently pay late. If your current client base struggles with timely payments, deferred terms could further delay your income.

- You lack reserves or credit access. Deferred payments can stretch your liquidity. If you don’t have access to a backup line of credit or invoice factoring solution, this could pose a risk.

- You’re in a high-turnover industry. If your customer base changes frequently (like in retail or e-commerce), building trust and extending credit can be more difficult.

In these scenarios, alternative financing tools, such as invoice factoring or partial upfront payments, may be better suited to your needs. These allow you to maintain flexibility for customers while protecting your own bottom line.

When Deferred Payment Terms Make Sense

Deferred payment terms aren’t suitable for every situation. But in the right context, they can help businesses grow, retain clients, and increase their competitiveness.

They make sense when:

- You’re working with a financial institution or customer with a proven payment history.

- You want to close a sale without requiring a large down payment.

- You’re entering a new market where offering flexible terms could be a competitive differentiator.

- You’re supporting clients through a challenging economic phase and want to preserve the relationship.

- You’re looking to establish recurring revenue with enterprise clients who prefer post-payment arrangements.

In these situations, it’s important to formalize expectations in writing and perform credit checks to minimize risk. Payment terms should be clear and enforceable.

Tips and Best Practices for Deferred Payment Terms

Offering deferred payment terms can support growth and customer retention, but only if managed strategically. Use these tips to set clear expectations, reduce risk, and protect your cash flow.

Negotiating Deferred Payment Terms With Customers

Negotiating deferred payment terms requires balancing your business’s need for predictable cash flow with your customers’ need for flexibility. A successful negotiation starts with understanding your customer’s financial standing and payment history. Before extending terms, assess the client’s creditworthiness using credit reports, trade references, or historical data if you’ve worked with them before.

When proposing terms, be specific. Outline the number of days allowed before payment is due (e.g., Net 30 or Net 60), any early payment discounts, late fees, and whether interest will accrue if the invoice isn’t paid on time. This transparency helps both parties avoid confusion or legal disputes later.

Here are a few strategies to consider when negotiating:

- Tiered terms based on order size. Offer longer terms for larger orders or repeat clients.

- Payment milestones. Break larger projects into stages with partial payments due at each milestone.

- Early payment incentives. Offer small discounts (e.g., 2% off if paid within 10 days) to encourage faster cash flow.

- Interest-free deferment for a limited time. Provide interest-free periods to build goodwill with new customers.

- Personalized terms for key clients. Your best customers may deserve more flexibility as part of a long-term relationship.

Clear communication is critical. Always document the terms in writing — preferably in your service agreement or purchase order — and confirm that both parties have agreed to the terms before any goods or services are delivered.

Managing Cash Flow

Offering deferred terms can stretch your cash reserves. To maintain liquidity, develop strong internal processes or work with external partners who can help.

One common strategy is invoice factoring. Instead of waiting 30 or 60 days for customer payments, you sell your outstanding invoices to a third-party funder, like Gateway Commercial Finance, and receive an immediate cash advance.

Factoring isn’t a loan, so it doesn’t increase your liabilities or affect your credit score. It’s simply a way to accelerate access to working capital (among other factoring benefits) while maintaining customer relationships.

Other strategies to manage cash flow include:

- Offering early payment incentives

- Breaking payments into smaller monthly payments

- Using software to track invoice status and send reminders

- Vetting customers before extending terms

- Breaking payments into smaller monthly payments

- Using software to track invoice status and send reminders

- Vetting customers before extending terms

- Partnering with a financial expert to forecast cash flow

- Monitoring your accounts receivable aging reports to catch delays early

- Having reserve capital or a line of credit available for emergencies

Businesses should also understand the difference between deferment and forbearance. While both offer temporary relief, forbearance often applies to legally binding loans and may come with different consequences if not managed properly.

Legal and Contractual Considerations

Deferred payment agreements should be clearly documented in a contract to avoid misunderstandings. Contracts should specify:

- Total amount due

- Payment due date or schedule

- Penalties for late payment

- Interest charges, if any

- Dispute resolution terms

It’s also a good idea to include clauses covering bankruptcy or default, which can protect the seller if the buyer is unable to meet their obligation. In some industries, especially finance and construction, contract law plays a major role in ensuring compliance.

Consulting with a legal or financial advisor before finalizing a deferred agreement can help reduce risk.

International and Cross-Border Transactions

In global trade, deferred payment terms play an important role in managing risk between importers and exporters. These agreements must also take into account:

- Currency fluctuations

- Political and economic stability

- Cross-border legal enforcement

- Trade financing options

Many international contracts use letters of credit or export factoring to provide payment security. When structuring a deferred agreement across borders, ensure terms are aligned with Incoterms and local regulations.

How Technology Is Transforming Deferred Payments

With the rise of digital payment platforms, automation, and blockchain, deferred payment terms are evolving. Businesses now use:

- Invoice automation tools

- Digital credit scoring and AI-based risk assessments

- Smart contracts for enforceable terms

- Real-time dashboards to monitor receivables

Fintech companies are also offering embedded finance options that allow deferred payments to be managed seamlessly within e-commerce platforms or enterprise resource planning (ERP) systems. This reduces friction and speeds up the approval process for buyers.

Make Deferred Payment Terms Work for Your Business

Deferred payment terms can be a powerful tool for building customer loyalty, expanding your sales pipeline, and staying competitive in your industry. However, they require a careful balance between flexibility and financial stability.

As with any credit-related decision, transparency, documentation, and clear communication are key. When used strategically, deferred payments can help you grow without overextending your resources. The right terms, backed by sound planning, can lead to stronger relationships and long-term financial health.

If you’re offering or accepting deferred terms and need to maintain access to cash, Gateway Commercial Finance can help. Our invoice factoring solutions provide fast funding without creating debt, so you can keep business moving.