Purchase Order Financing: How It Works, Rates and Terms

Table of Contents

- The Definition of Purchase Order Financing

- How Does Purchase Order Financing Work?

- P.O. Financing Example

- Who Can Benefit From P.O. Funding?

- Pros and Cons of Purchase Order Finance

- How Much Does Purchase Order Financing Cost?

- Purchase Order Financing and Factoring

- Working With a Purchase Order Financing Company

Did your business just land a major order, but you lack the upfront funds to fulfill it? You’re not alone. For many companies, the biggest challenge isn’t getting orders — it’s having the capital to pay suppliers. The good news is that purchase order financing (P.O. financing) can help you deliver on large contracts without straining your cash flow.

With P.O. financing, you can access up to 90% of the supplier costs required to fulfill a customer order.

In this guide, we’ll break down how P.O. financing works, what it costs, who it’s ideal for, and how to get started in securing the cash advance you need to secure growth opportunities for your business.

Note: If you are seeking purchase order (P.O.) funding, please be aware that we do not offer standalone purchase order funding services. Instead, we require your business to factor the invoice once the supplier has delivered the order. You can learn more about this type of service later in this article.

What Is Purchase Order Financing?

Purchase order financing is a form of short-term business funding where a finance company pays your supplier directly to fulfill a customer’s purchase order.

Once the order is shipped and invoiced, the financing company/lender collects payment from your customer, subtracts its fees and the amount advanced, and sends you the remaining balance.

P.O. financing is a popular type of financing for businesses that don’t have the cash to cover large supplier payments upfront. P.O. financing companies advance between 70% and 100% of the order amount. After paying the vendor, they wait until the customer pays to recover the funds and deduct their fees.

How Does Purchase Order Financing Work?

Funding amounts for purchase order financing typically cover 70% to 90% of your supplier’s invoice, though in some cases, 100% funding is possible, though rare. As for timing, first-time approvals generally take between one and two weeks, while returning clients can often receive financing in just a few days.

As for purchase order financing costs, most providers charge 3% to 6% per month. Short-term deals may be around 2% for 10–15 days. These are flat fees, not interest-based.

Four different participants take part in a P.O. funding transaction:

- You (the seller/borrower)

- Your customer (the buyer)

- Your supplier

- The purchase order financing company (lender)

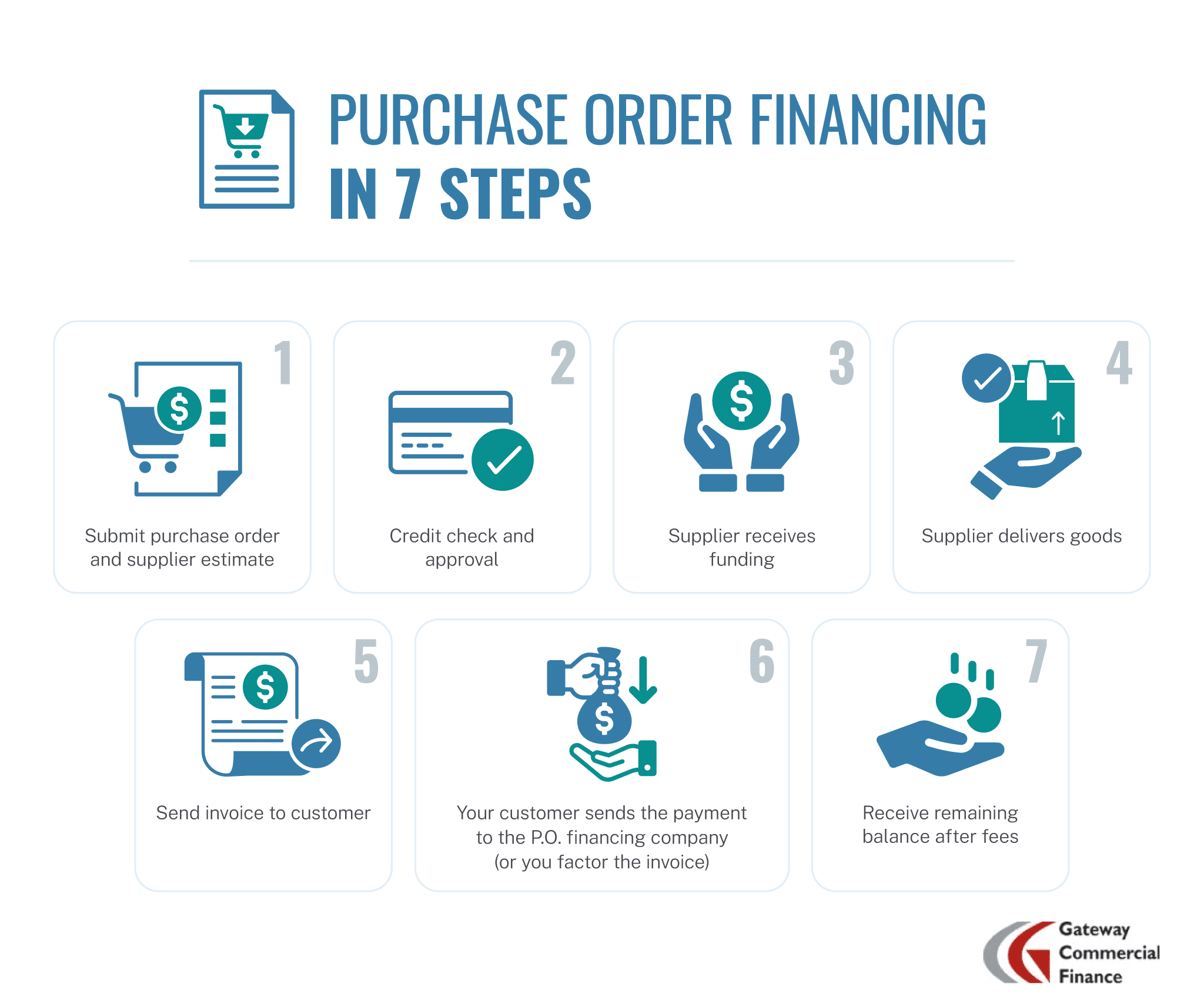

Here’s how the P.O. funding process works

- You get a purchase order from a customer and an estimate from your supplier, and contact a P.O. finance company.

- Approval process: The P.O. finance company checks the credit history of your client and supplier.

- If approved, the creditor advances your supplier 70 to 100% of the purchase order cost.

- Your supplier delivers the order.

- You issue an invoice to your client.

- The customer sends the payment to the P.O. financing company (or gets payment terms, and you factor the invoice).

- The P.O. financing company receives the money, discounts its fees and amount paid to the supplier, and sends the balance to your bank account.

Purchase Order Financing Example

Building Contractor Inc. wants to buy some electrical outlets that you distribute and has placed a purchase order for $100,000. You contact your supplier, Electrical Manufacturer LLC, and get an estimate for $60,000. Unfortunately, you don’t have enough working capital to cover those goods’ costs.

Here’s how you would get purchase order financing to help:

- You contact a purchase order finance company and request financing.

- The P.O. financing company evaluates the order and assesses your client’s financial background and credit history. Then, it does the same with your supplier. If the analysis is satisfactory, the financing is approved.

- Your business signs a purchase order (P.O.) financing agreement with the financier, which includes the following terms: 80% of the estimated amount is financed, and you are responsible for covering the remaining 20%. A fee of 4% applies every 30 days.

- The P.O. financing company issues a letter of credit or a vendor guarantee to Electrical Manufacturer LLC.

- After a 30-day wait, the products are delivered to Building Contractor Inc.

- The P.O. financing company pays the electrical manufacturer $48,000, and you pay the $12,000 balance.

- You send Building Contractor Inc. an invoice.

At this stage, two things can happen:

- Your customer immediately pays the P.O. financing company. We’ll keep explaining this option in this example.

- You give your client payment terms (e.g., 60 days from invoice date) and use invoice factoring to cancel the 80% advance and get financing until the customer pays. You can read more about how this process works later in this document.

Building Contractor Inc. pays right away. The P.O. financier receives the $100,000 payment. Then it discounts the $48,000 paid to the supplier and $1,920 in fees (4% pre-agreed) and sends you the remaining $50,080.

Who Uses Purchase Order Financing?

P.O. financing works best for product-based businesses that need help covering supplier costs for large orders.

Eligible business types include:

- Wholesalers and distributors

- Importers

- Exporters

- Small business owners

- Manufacturers

- Government contractors

- Resellers and drop shippers

- Previous GCF customers with a good track record

It’s most useful for:

- Poor or limited credit history

- Cashflow gaps

- Alternative financing solutions have failed

- Seasonal cash flow shortages

- A sudden surge in orders

- Rapidly scaling startups

- Limited access to traditional bank financing, credit cards, or a line of credit

- All other financing options have faltered

Note: Service-based businesses typically don’t qualify for P.O. financing.

Pros and Cons of Purchase Order Financing

Advantages of purchase order financing include:

- Easier to qualify for than traditional loans

- It doesn’t show up as debt

- No personal guarantees are required

- Collection handled by a financier

- Based on the creditworthiness of your customers

- Fast approval and funding

- Keeps working capital available

- Enables you to fulfill larger orders

The potential disadvantages are:

- Rarely covers 100% of the supplier cost

- Your customer will know a third party is involved

- Only available for tangible product sales

- More expensive than bank loans

- Some companies only fund large P.O.s

- Customers and suppliers must be creditworthy

What Does Purchase Order Financing Cost?

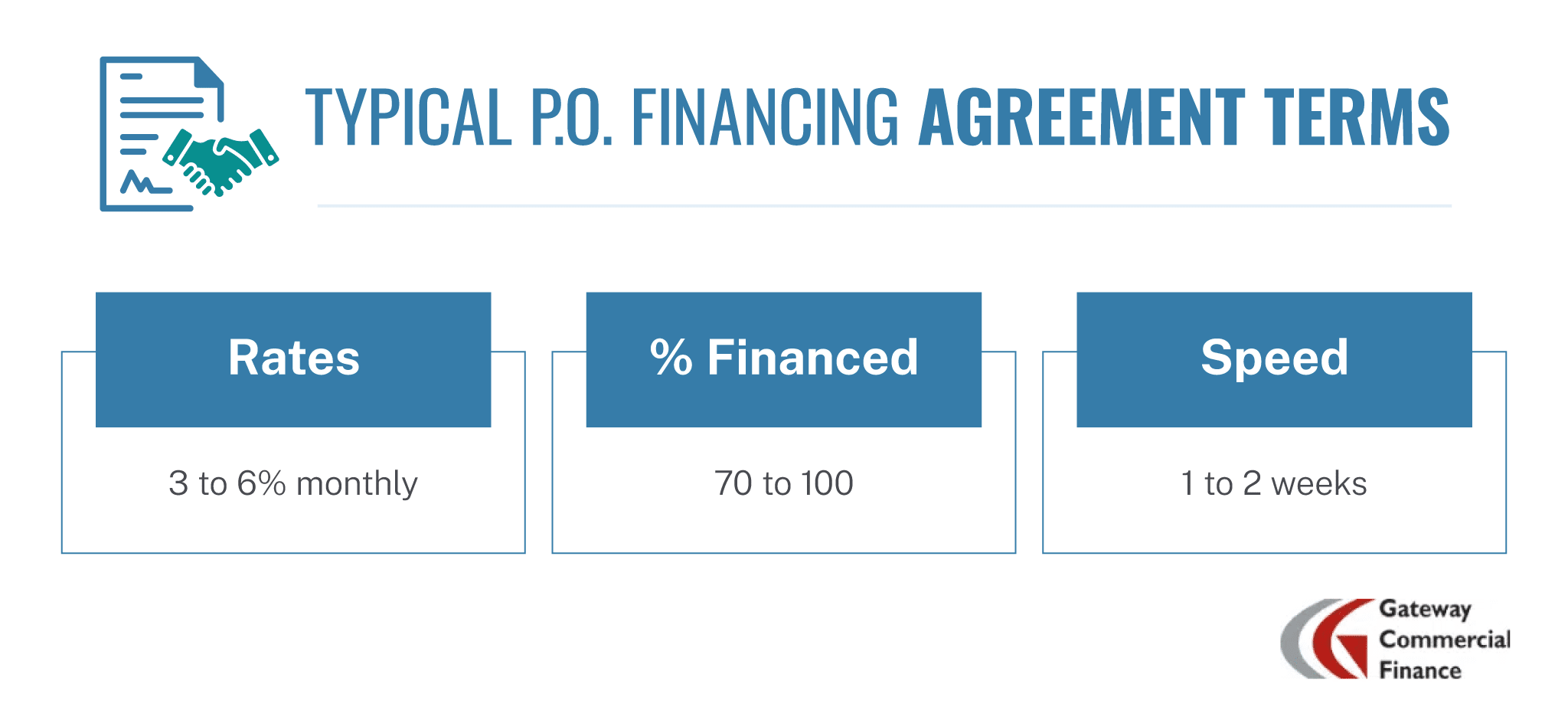

The following are the most common terms in P.O. financing agreements today.

Purchase Order Financing Rates

P.O. financing rates can vary considerably among providers and transactions. The most common are 3 to 6% per month, but a few providers offer terms as short as 7 to 15 days (e.g., 2% for 10 days).

Essentially, P.O. Funding is an unsecured loan, and the discount fees reflect the risk each transaction involves. Still, the costs are low in comparison to short-term alternative loans.

Amount Financed

With P.O. funding, advances are provided to cover the cost of supplies, typically between 70% and 90% of a purchase order amount. 100% finance is not impossible to get but very unusual.

Funding Speed

The first time you request financing for specific clients and providers, the transaction can take 1 to 2 weeks to fund. Repeated deals and ongoing relationships can be funded in just a few days.

P.O. Financing & Invoice Factoring: A Two-Part Strategy

Our company exclusively provides purchase order funding services to businesses that commit to utilizing factoring services after the order has been delivered.

Invoice factoring is a financial transaction frequently used by businesses with weak cash flow that give their customers payment terms. Instead of waiting to get paid, the business sells the receivable to a factoring company and receives a cash flow advance. Then, the factor waits for the payment, deducts its fees, and gives the business the balance.

It’s very common for businesses to factor the invoices right after the orders are delivered because factoring is cheaper than purchase order funding. Instead of paying the typical purchase order finance fees of 3 to 6% a month while waiting to get paid, you can save money by taking advantage of the 1 to 3% invoice factoring rates.

Here’s how it works:

- The receivable is factored right after the supplier delivers the goods and the business issues a bill.

- A portion of the invoice factoring advance is used to pay off the purchase order financing amount and fees owed.

- The arrangement becomes an invoice factoring deal, financed until the debtor pays.

This strategy prevents cash flow crunches and helps you save money by considerably decreasing the amount paid in financing fees.

You can learn everything about invoice factoring and how it works here.

Working With Our Purchase Order Funding Company

We can help growing businesses finance their ability to fulfill purchase orders. We provide funding to buy materials and finished products, pay workers, or any other input needed to complete the sale and generate an invoice.

Our purchase order funding solutions come in two forms. We can either guarantee payment directly to the vendor or establish a line of credit with the vendor. In either case, we help cash-strapped businesses get the materials they need to meet their clients’ demands.

NOTE: We don't provide standalone purchase order funding services. Instead, we require your business to factor the invoice after the supplier delivers the order.

P.O. Financing FAQ

Have questions about how purchase order financing works, what you need to qualify, or how it compares to traditional financing? Here are some quick answers to help you understand the essentials.

What’s the difference between purchase order financing and invoice financing?

Purchase order financing helps you pay suppliers before the goods are delivered, while invoice financing (or factoring) provides funding after you’ve invoiced your customer. We combine both for a seamless cash flow solution.

Do I need a strong credit score to qualify for P.O. financing?

Not necessarily. Approval is based more on your customers and suppliers’ creditworthiness than your own. This makes P.O. financing accessible even if your business has a limited credit history.

Is purchase order financing better than a business loan or line of credit?

It depends on your situation. P.O. financing is faster and easier to qualify for than traditional financing and doesn’t add debt to your balance sheet. However, a business loan or business line of credit might offer lower long-term costs if you qualify.

What financial statements are needed to apply?

Typically, you’ll need to provide recent financial statements, supplier estimates, and the purchase order from your customer to begin the underwriting process.

How does underwriting work for P.O. financing?

The underwriting process includes a review of your accounts receivable, customer and supplier creditworthiness, and any prior qualifying business activity. This ensures the transaction is low-risk for all parties involved.

Our Purchase Order Financing Services

We help small and mid-sized businesses fund the goods they need to fulfill large customer orders. We offer:

- P.O. financing from $50,000 to $250,000

- Letters of credit or vendor guarantees

- Quick approvals based on your customer’s creditworthiness

Reminder: We only provide P.O. financing when paired with invoice factoring.

Why Partner With Us?

- Fast, dependable funding

- Competitive interest rates

- Our application process is easy

- Stronger supplier relationships

- Confidence to take on larger contracts

- Meet delivery deadlines and grow with ease

Ready To Move Forward?

Stop turning down large orders because of limited cash flow.

Call 1-855-424-2955 to speak with our P.O. financing team. We’ll walk you through your options and help you grow — deal by deal.

Author Marc J Marin