More About Factoring

You are in the right place if you are looking for the definition of factoring agreements, examples, and the most common terms included in these contracts.

If you instead got to this page looking for information about finance factoring services or are trying to get a proposal and potentially sign an agreement, please request a quote or contact us at 1-855-424-2955. Our managing director will take care of your needs right away.

In this detailed article, you’ll get information about the following subjects:

- Factoring Agreement Definition

- Typical Clauses & Security Terms

- Seven Real Examples of Factoring Agreements

- Frequent Questions

Important Disclaimer: This is an informational article, and we are not providing legal advice. We strongly suggest you consult an attorney before signing any contract.

Factoring Agreements Explained: Structure, Risks, and Examples

A factoring agreement is a contract between a business and a factoring company that lays out the terms for selling accounts receivable in exchange for immediate cash. Instead of waiting 30 to 90 days for customers to pay their invoices, businesses can use invoice factoring to improve cash flow and access the working capital they need to stay on track.

This guide is designed for two types of readers: business owners and financial decision-makers who are researching factoring contracts for a better understanding, and those ready to explore funding options and request a quote. We’ll break down what’s typically included in a factoring agreement, explain the key terms you need to know, and provide real contract examples you can download for reference.

Whether you’re comparing funding options or getting ready to sign, this resource will help you make a more informed, confident decision.

What Does a Factoring Agreement Include?

A factoring agreement outlines the specific terms under which a business sells its outstanding invoices to a factoring company in exchange for upfront cash. While each contract is customized, most agreements include several common elements that govern the relationship and define both financial terms and operational responsibilities.

Here are the core components typically found in a factoring agreement:

- Purchase price. The agreed amount the factor will pay for each invoice amount, usually a percentage of its face value, after adjusting for any customer discounts.

- Advance rate. The percentage of the invoice value you receive as an upfront cash advance when the receivable is sold.

- Factoring fee. Also called the discount rate, this is the fee the factor charges for the service, typically a percentage of the invoice value.

- Reserve account. A portion of funds held back by the factor to cover chargebacks or adjustments; released after the final customer payment.

- Payment terms. These outline when and how the factor pays the client and receives payments from the customer.

- Security interest. A clause that allows the factor to place a lien on business assets (such as receivables) as collateral.

- Default clauses. Terms that describe what happens if the client breaches the agreement, misses payments, or becomes insolvent.

- Customer creditworthiness. Most factoring agreements include customer credit limits based on credit checks, not your company’s credit score.

These sections define the financial framework of the factoring arrangement and set expectations for both sides.

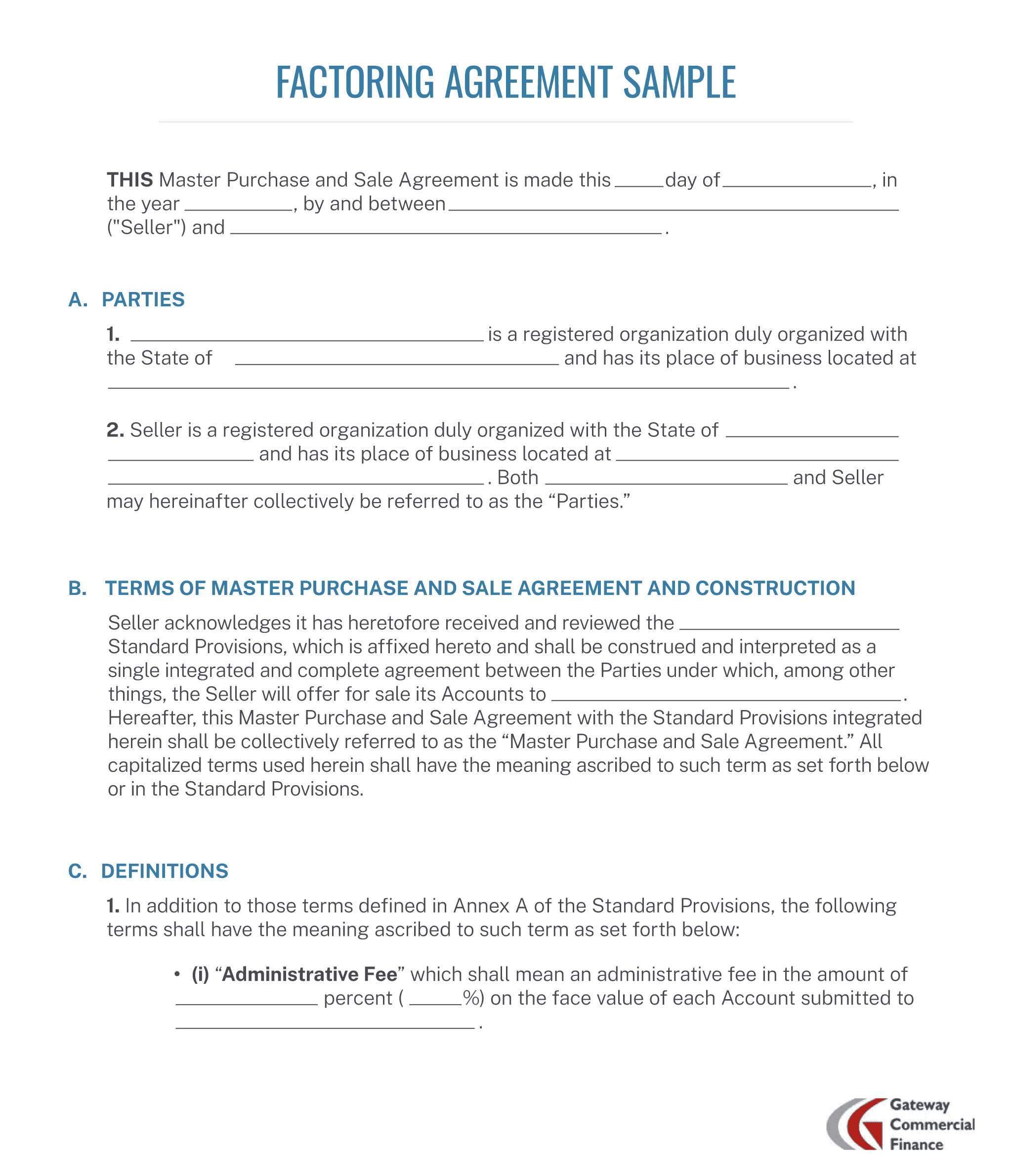

Invoice Factoring Agreement Examples + PDF Downloads

Because factoring agreements are tailored to each provider and client, there’s no one-size-fits-all contract in the industry. However, reviewing real-world examples can help you understand the structure, terminology, and common clauses used in various types of factoring.

Below are descriptions of common types of invoice factoring agreements and elements:

- Basic recourse factoring agreement. Outlines client responsibility if the customer fails to pay.

- Non-recourse factoring contract. Includes terms where the factor assumes the risk of non-payment due to insolvency.

- Notice of assignment. Shows standard language used to notify customers that payments are now due to the factor.

- Reserve account provisions. Highlights how reserves are held and when they’re released.

- Termination clause. Demonstrates early termination language and associated fees.

- Security interest and UCC language. Details how a lien is placed on assets to protect the factor’s interest.

- Industry-specific factoring agreement. Tailored contract for high-volume invoice businesses like freight and logistics.

7 Sample Business Factoring Agreements

As promised earlier, here are some real examples of factoring contracts (click to download PDF files):

- Most Industries – Full Recourse

- Most Industries – Full Recourse II

- Most Industries – Full Recourse III

- Services – Full Recourse

- Transportation/Trucking – Full Recourse

- Transportation/Trucking – Full Recourse II

- Transportation/Trucking – Non-recourse

- Extra bonus from a web source

If you want an example of our typical contract, please contact us or call 1-561-734-2706.

Are Factoring Contracts Standard?

Not at all. While many contain similar terms, each factoring agreement contract example reflects the unique policies of the provider. Contracts are drafted with legal counsel and often customized further for individual clients.

Need a sample tailored to your industry? Contact us for a custom quote or call 1-855-836-0113 for a personalized document.

Key Clauses to Understand Before Signing

Before entering into any factoring agreement, it’s important to understand the specific agreement terms that will govern how you receive funding, what it costs, and what happens if things go wrong. These clauses shape the factoring process, your financial flexibility, and your risk exposure.

Advance Rate and Reserve Requirements

Your advance rate is the percentage of the invoice amount you’ll receive upfront, typically between 70% and 90%. The rest is held in a reserve account, which acts as a buffer for chargebacks or disputes. The reserve is released once the customer pays the invoice, minus any applicable fees.

Factoring Fee Structure and Discount Rates

The factoring fee (also called the discount rate) is the main cost of using factoring services. It may be a flat factoring rate or vary based on how long the invoice remains unpaid. Review these details carefully to avoid surprises; hidden fees can significantly affect your returns.

Termination Provisions and Early Exit Fees

Most agreements include termination provisions, outlining how and when you can exit the contract. If you try to leave early or fail to meet certain volume thresholds, a termination fee or administrative penalty may apply. Always understand the renewal terms and notice requirements before signing.

Auto-Renewal and Exit Process

Many factoring contracts include an automatic renewal clause. Unless the client provides written notice, often 30 to 60 days before the end of the term, the agreement may be renewed for another period.

Exiting a contract early often incurs termination fees or administrative penalties. If all outstanding invoices are not collected or reserve balances are unsettled, the contract may remain in effect. Always check notice periods and early termination conditions.

Security Interests and UCC Filings

Factoring companies typically file a UCC-1 financing statement to establish a security interest in your assets. This gives them legal rights over accounts receivable, inventory, and other business property in the event of default. These filings are standard but should be clearly explained in the contract.

Types of Collateral Typically Included

In most factoring agreements, the factor will require a lien on business assets as security for the agreement. This security interest, often filed as a UCC-1, may cover more than just receivables. It can include:

– Accounts receivable and outstanding invoices

– Inventory, equipment, and business property

– Chattel paper, contract rights, and general intangibles

– Bank accounts and deposit accounts

– Intellectual property and even real estate

This broad collateral scope protects the factor’s position if the agreement defaults.

Event of Default and Remedies

Default clauses define what triggers a breach of contract and what remedies the party can pursue. Common triggers include nonpayment, misdirected customer payments, inaccurate reporting, or insolvency. The factor may terminate the agreement, claim all outstanding amounts, or pursue legal action, depending on the risk of nonpayment.

Examples of Default Events

Default clauses can cover a wide range of triggers. Common events of default include:

– Unauthorized collection of payments by the client

– Failure to provide financial information or customer updates

– Client insolvency or bankruptcy filing

– Disputes with debtors that are not disclosed to the factor

– Non-payment of taxes or government obligations

– Fraud or misrepresentation of receivables

In some contracts, even prematurely ending the agreement without proper notice can be considered a default.

Recourse vs. Non-Recourse Factoring Agreements

One of the most important distinctions in any factoring agreement is whether it’s recourse or non-recourse. This difference determines who takes on the credit risk if a customer fails to pay due to insolvency or other financial issues.

In recourse factoring, the business remains responsible for unpaid invoices and must buy them back or replace them. In non-recourse factoring, the factoring company assumes the loss, but only under specific conditions, like the customer filing for bankruptcy. Here’s a direct comparison of the two:

Criteria | Recourse Factoring | Non-Recourse Factoring |

Responsibility for non-payment | Business (you) covers any loss | Factor covers loss due to insolvency or approved risk |

Chargebacks | Required for unpaid invoices | Usually not required unless outside agreed-upon terms |

Factoring fee | Lower rates | Higher rates due to greater risk |

Credit checks | Still performed on customers | Essential and often more stringent |

Use case | Businesses with reliable, creditworthy customers | Businesses seeking added protection from credit risk |

Understanding these differences helps you choose the right agreement based on your industry, customer base, and tolerance for risk.

How To Review a Factoring Contract (Checklist)

Before you sign a factoring arrangement with any financial institution, it’s essential to know exactly what you’re agreeing to. This checklist helps business owners review key contract terms that could impact cash flow, costs, and legal obligations down the line.

Use this as a starting point to ask the right questions and flag anything that needs clarification before signing.

- Advance rate. What percentage of the invoice amount will you receive upfront?

- Factoring fees. What is the discount rate, and how is it calculated: flat fee, tiered, or time-based?

- Reserve account terms. How much is withheld, and when are reserves released?

- Termination clause. Are there termination fees or penalties for early exit?

- Minimum volume commitments. Are you required to factor a certain amount monthly?

- Security interest. Will the factor file a UCC lien on your assets?

- Customer interaction. Will your clients be notified, or is non-notification an option?

- Event of default. What actions or conditions can trigger a default?

- Additional fees. Look for hidden fees like setup, wire, or admin charges.

- Governing law. Which state laws apply if there’s a dispute?

Reviewing these details upfront ensures that your factoring agreement aligns with your operational and financial goals.

FAQs About Factoring Contracts

Whether you’re exploring your first factoring agreement or reviewing terms before signing, it’s normal to have questions. These common FAQs clarify key concepts like contract terms, legal obligations, and what to expect when working with a factoring company.

What Is a Notice of Assignment?

A Notice of Assignment (NOA) is a formal notification sent to your customers informing them that your accounts receivable have been sold to a factoring company. It includes payment instructions and confirms that future invoice payments must be made directly to the factor.

How Do I Get Out of a Factoring Agreement?

Most contracts include termination provisions that outline how to exit the agreement. Typically, you must provide written notice before the end of the contract term and ensure all factored invoices are settled. Exiting early may trigger a termination fee, so always review your contract terms carefully.

Are There Hidden Fees in Factoring Contracts?

Some providers include additional fees like setup, wire transfer, and administrative charges. These may not be clearly labeled in your contract, so it’s important to review the full fee structure and ask about any potential charges upfront.

Can I Negotiate the Terms of a Factoring Agreement?

Yes, many factoring companies are open to negotiating agreement terms such as advance rate, factoring fee, minimum volume requirements, or even specific clauses like termination provisions. Customization is common, especially for small businesses with unique cash flow needs.

Is a Factoring Agreement Legally Binding?

Yes. A factoring agreement is a legally enforceable contract between your business and the financial institution providing the factoring services. Once signed, both parties are bound by the terms unless mutually amended or terminated under the agreed conditions.

How Does Bankruptcy Affect Factoring Agreements?

If your company enters bankruptcy (e.g., Chapter 11), the treatment of your factoring agreement depends on when the contract was signed and its specific terms.

- If factoring began before filing, some factors may terminate the agreement unless court-approved debtor-in-possession (DIP) financing is arranged.

- If you seek factoring while already in bankruptcy, some providers—including Gateway—may offer DIP factoring solutions tailored to your situation.

In either case, coordination with legal counsel is essential.

Why Gateway Commercial Finance Is a Trusted Factoring Partner

With more than 20 years of experience, Gateway Commercial Finance has built a reputation for reliability, speed, and transparency. We understand that no two businesses are alike, which is why we offer flexible, customized factoring agreements designed around your specific cash flow needs.

- Decades of expertise. Our team brings over two decades of experience serving small businesses in diverse industries.

- No hidden fees. What you see is what you get. Every cost is clearly outlined up front.

- Fast decisions. You get direct access to decision-makers, not bots or brokers, for faster approvals.

- Flexible contracts. We tailor our terms to your sales cycle, client mix, and industry conditions.

If you’re looking for a partner that values speed, clarity, and long-term relationships, we’d love to hear from you.

Contact us today for a personalized factoring proposal that fits your business goals.

More Resources