After years of working with over 1,000 factoring clients across various industries, we have amassed a wealth of data on the payment terms businesses extend to each other. Over the last three years, we analyzed client data to learn industry trends and patterns in NET terms. Our research revealed how different sectors manage payment timelines and the impact on cash flow.

Whether you are new to B2B transactions or looking to improve your payment strategies, this research outcome can help you understand the typical NET terms in your industry. With this knowledge, you can negotiate better deals, manage cash flow effectively, and stay competitive.

Industry Benchmarks: Typical Payment Terms by Industry

Here’s what we found when analyzing the real payment practices of companies across sectors:

- Manufacturing & Wholesale Distribution

- Typical Terms: NET 30 to NET 90

- Why: Larger buyers and high order volumes make extended terms common. Key retailers or long-term partners often demand NET 90.

- Construction

- Typical Terms: NET 30 or Pay-on-Pay

- Why: Payment terms are often tied to project milestones or completion, which requires considerable monitoring and testing to ensure that work is completed and satisfactory. In the construction industry, it’s very common for sub-contractor payments to be dependent on the General contractor to receive payment from the project owner.

- Technology & SaaS

- Typical Terms: NET 15 to NET 90

- Why: Subscription-based models and rapid service delivery favor shorter payment cycles. Custom software development may require upfront payments or due-on-receipt terms. In some instances, larger companies with legacy software will require Net 90-day payment terms.

- Transportation & Logistics

- Typical NET Terms: NET 15 to NET 30

- Why: Quick operational turnarounds demand faster payments.

- Staffing & Payroll Services

- Typical Terms: NET 7 to NET 60

- Why: Companies need fast payments to meet payroll obligations. Trusted, long-term clients might secure NET 30 or NET 45-day terms but be prepared to wait up to 60 days for payment. Medical-centered staffing providers can expect to wait as long as NET 90 days to get payment due to the slow processing by acute and long-term care facilities. Free cash flow by these types of businesses is rare, and extending payments to vendors is often the norm.

- Advertising & Marketing

- Typical Terms: NET 60 to NET 90

- Why: Agencies representing Clients often demand longer terms for larger projects, but vendors may push for shorter cycles. Retainers and prepayments are common for ongoing work.

- Security Services

- Typical Terms: NET 15 to NET 30

- Why: Security companies need prompt payments to manage regular payrolls like staffing. Larger clients might negotiate NET 45 terms.

- Agriculture & Food Supply

- Typical Terms: NET 7 to NET 21

- Why: Perishable goods require quick turnover. Some suppliers might even demand immediate payment for high-demand or sensitive products. PACA laws dictate payment terms not to exceed Net 21.

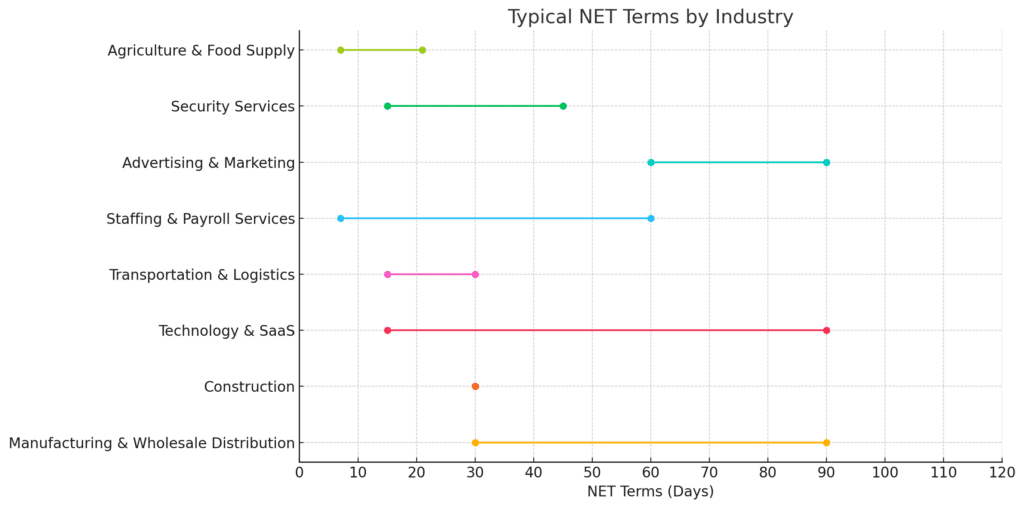

Visualizing NET Terms Across Industries

We have created a chart based on our research conclusions to help you better illustrate the range of NET terms across industries.

This chart highlights the minimum and maximum payment terms commonly offered in each sector, so you can quickly see how your business compares and where your terms fall within industry norms.

Why Should You Care About Your Industry’s NET Terms?

Knowing what’s standard in your industry gives you a clear advantage. It helps you:

- Set fair and competitive payment terms

- Negotiate from a stronger position

- Manage your cash flow more effectively

Whether you’re trying to win more business or reduce financial strain, understanding NET benchmarks can help you make better decisions and build stronger client relationships.

Do You Need to Get Paid Faster? We Can Help.

If long payment cycles are putting pressure on your business, factoring might be the solution.

At Gateway Commercial Finance, we help businesses unlock immediate cash by advancing payment on outstanding invoices. Whether you’re in staffing, security, transportation, or another B2B sector, we offer industry-specific solutions to fit your needs.

- Meet payroll

- Pay vendors on time

- Grow without waiting 30, 60, or 90 days

Contact us today to see how our factoring services can keep your business moving forward.

More Resources