Why Is Important To Constantly Keep Track Of Your Cash Flow?

Back to:

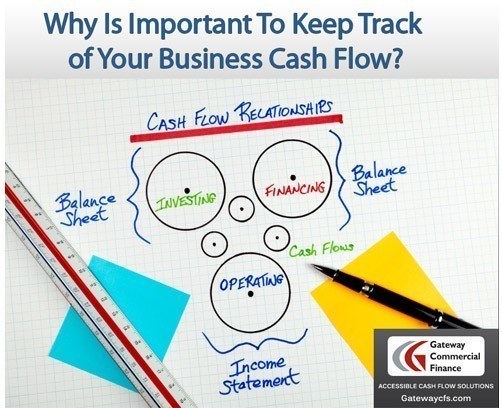

Managing Your Business Cash Flow

Large and small enterprises rely on cash inflows resulting from sales, investments, loans, and other sources. These inflows are offset by cash outflows or disbursements to fund inventories, payroll, capital expenditures, investments, and operational expenses.

Cash flows represent the lifeline of any business. Positive cash flow is essential for the survival of your business. Unfortunately, maintaining positive cash flows can challenge you and your business. When you run into cash flow challenges, you cannot pay your bills on time, risking a decrease in your credit line or higher interest rates.

Cash flow management involves the forecasting of these flows, recognizing that the timing of inflows often does not match outflows, and planning to compensate for cash flow fluctuations while maintaining sufficient reserves to cover operational and capital needs. Of course, managing cash flow also involves ensuring that customers pay on time by establishing effective accounts receivable, credit, and collection policies as well as reducing outflows by eliminating operational inefficiencies and waste.

Risks of not managing cash flow efficiently

Cash is king! You have to pay your suppliers and employees so that you can produce and sell your products. Your customers pay you after they receive the products they ordered. So you need cash to front the production of goods and maintain inventory. That lag between your outflow of cash and inflow from customers needs to be carefully monitored. The longer your average receivables stretch out, the more cash you must put into the business to maintain its viability. Cash flow management is delaying cash outflow for a reasonable length of time and ensuring your customers pay on time.

Several factors might contribute to the cash flow problems of your business:

Poor Collection Practices

Extending credit to customers offers flexibility and convenience. This serves to build your business and customer base. Extending credit also means you need to manage the collection process. Asking customers to pay their bills can be a daunting task. You may prefer to focus on the operation of your business rather than make collection calls. However, when you extend credit to customers, you experience zero cash flow until your customers pay. If your customers fail to pay their bills on time, your business will suffer the consequences.

Poor Budgeting

Budgeting allows you to plan where and when you want to spend money on your business. This budgeting process depends on understanding when your bills are due and when you will receive customer payment. If your budget fails to consider the timing of these payments, you may be caught struggling to pay bills when you haven’t yet received any money from your customers.

Inadequate Savings

Many small businesses experience seasonality with their sales. For example, if you own a landscaping company, you may experience increased sales in the summer. If you own a retail store, you may experience increased sales before Christmas. You will experience a decline in sales at other times of the year. To meet your cash flow needs, you must build up savings to meet your needs during these times. Business owners who fail to save enough money to endure the slow times will experience cash flow problems.

Unplanned Expenses

Any business can be hit with unplanned expenses. Maybe your furnace needs to be repaired, or an unhappy customer takes legal action against your company. Since you are likely not planning these expenses, you must find other sources to pay for them. If you pull this money from the business bank account, you will lack the necessary funds to pay your current obligations.

Poor cash management can be disastrous to businesses and business owners. A company that cannot fund current operating expenses and cannot meet payroll is effectively out of business unless immediate cash flow financing can be arranged.

Your accounts receivable is your source of cash. You need to ensure that your customers are paying on time. There are measurements such as Days Sales Outstanding (DSO) to determine how effective you are in collecting, but in the end, you need to keep track of what each of your customers owes you. Providing too much credit or letting the customer hold back payment does not help the customer or you. The further a customer stretches payments, the harder it is to collect. Monthly statements and regular follow-up calls are essential to maintain a collection level and provide you with the cash to pay your bills.

Your vendors typically expect payment within 30 days. Maintaining a good credit standing with your vendors helps you get better prices and credit terms. It also avoids having to pay in advance for purchases. Late payments hurt your credit, not only with a particular vendor but also with the other vendors and the financial community. One of the first things a financing firm looks at is your credit rating. A good credit rating equals lower interest rates on borrowing and more funds available. Conversely, a poor credit rating costs higher interest rates and limited borrowing ability.

Even if measures can be taken to delay vendor payments and play bank float, the result is often exorbitant overdraft fees and an eroded credit rating that can worsen an already lousy cash situation.

Effective and diligent cash management is essential to the success of any enterprise.