How small businesses adapted to tighter commercial lending standards in 2025

How small businesses adapted to tighter commercial lending standards in 2025

The Federal Reserve’s Senior Loan Officer Opinion Survey from Q1 in 2025 suggests that it has become more challenging for small businesses in the United States to secure commercial and industrial loans. As economic uncertainty rises, banks are becoming more hesitant to lend money to low-collateral businesses.

With credit tightening, small businesses have to change their business strategies and take action to make themselves more creditworthy. Failure to do so could lead to an inability to secure traditional financing.

Using current data from the Federal Reserve, Gateway Commercial Finance, an invoice factoring company, offers insights into the commercial lending slowdown, how it’s affecting small businesses, and what companies can do to ease the burden of a credit squeeze.

2025’s trends in business lending and credit

The start of 2025 marked optimism for small businesses. The Small Business Optimism Index by the National Federation of Independent Businesses experienced a slight 2.3 point drop to 102.8 at the start of January, still above the historical average of 98.

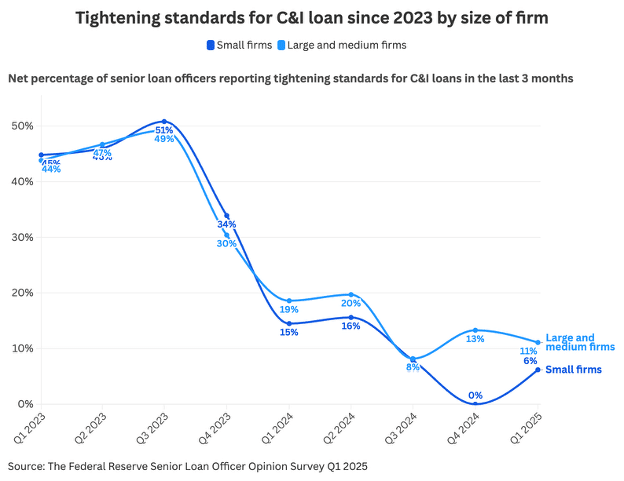

Despite this optimism, the Federal Reserve reported tighter lending standards for businesses of all sizes, notably small businesses (11.1% net for small vs. 6.2% for large and medium). This is higher than the third quarter of 2024 (8.2%), suggesting that banks are preparing to tighten their credit requirements further. In Q2 of 2025, 15.9% of lenders ended up reporting that they were tightening their standards.

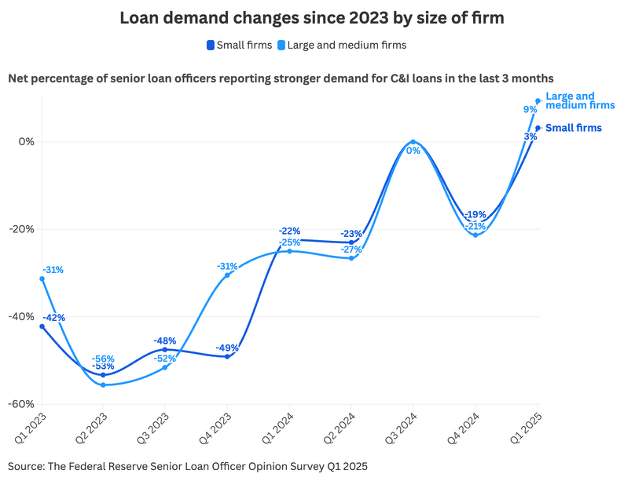

Small business credit demand decreases

With tighter lending standards and higher interest rates, small businesses have taken a step back from requesting loans. In Q4 of 2024, -18.6% of lenders were reporting stronger demand for C&I loans. While this rose slightly in Q1 of 2025, demand continued to decrease in Q2 and Q3, with lender response rates of -20.6 and -27.9, respectively. This indicates the credit interest from businesses is continuing to decline throughout the year.

This lower credit demand can suggest that there is economic uncertainty in the market. If businesses are more unsure whether they need additional borrowing capacity to support new business, will be able to pay off their loan or afford the interest rates, they are less likely to pursue credit in the first place.

Banks are tightening their standards

Credit tightening occurs in response to economic uncertainty. A major cause of this uncertainty is monetary policy shock, as described by the Federal Reserve.

When credit tightening happens, it’s harder for businesses to get approved for loans. This is especially the case for small businesses, as they may not be able to meet cash flow or collateral requirements. Some of the ways in which banks tighten credit include:

- Higher interest rates

- Lower loan amounts

- Larger down payments

- Lower maximum debt-to-income ratios

At the end of 2024, a larger percentage of loan officers (13%) reported that they were making credit requirements stricter, up from 8% in the previous quarter. While loan tightening continued to occur in the first quarter of 2025, it was not as prevalent at 11%.

How credit tightening can affect small businesses

Small businesses rely on loans and credit to help them achieve their financial goals. A total of 86% of small employer firms even use personal credit to obtain loans, according to the Consumer Financial Protection Bureau. Additionally, the Office of Advocacy reports that 61% hold $100,000 or less in debt at any given time. Small businesses use credit to pay start-up costs, wages, monthly expenses, and other forms of debt.

When smaller enterprises do not have adequate credit available to them, their finances must change. Small businesses may find it harder to keep operations running and may have to find alternative methods of cash flow.

Adapting to financing strain and how businesses overcome it

When credit lines tighten, there are a few strategies that small businesses take to stay ahead. The first is to take credit when it’s available, rather than waiting for when it’s needed. Businesses should take advantage of favorable balance sheets and cash flow while they have them, so financing is secured when things get tight.

Exploring alternative financing options

Many businesses have to turn to alternative financing options when credit tightening happens. While traditional banks typically offer the best terms and interest rates, there are options available for businesses that do not qualify due to stricter lending requirements.

Credit cards are one of the most common. The Small Business Administration reports that 46% of small businesses use personal credit cards to maintain cash flow. While riskier than other lending forms, they provide quick cash that is normally interest-free if repaid on time.

Asset-based lending is another option for strapped borrowers. This is when collateral is used to secure credit, typically inventory, equipment, and accounts receivable balances. While an effective form of credit, the qualifications are almost as stringent as a bank loan but funding availability may be greater.

Conclusion: Small businesses should prepare for tighter credit

Credit is an important tool that small businesses depend on to accelerate the growth of their business. With the Federal Reserve reporting tighter lending requirements and less credit demand, business owners may want to prepare themselves for reduced financing opportunities.

By adapting the business for this financial strain and exploring alternative lines of credit, small businesses can stay afloat, even during times of economic uncertainty. In addition, economic measures like the Senior Loan Officer Opinion Survey change with every new quarter and are not always indicative of future metrics, so the lending landscape is always changing. By staying up to date with these macroeconomic trends, small businesses can stay one step ahead of financial strain.

This story was produced by Gateway Commercial Finance and reviewed and distributed by Stacker.